BERLIN — Russia’s invasion of Ukraine seemed like an unexpected opportunity for environmentalists, who had struggled to focus the world’s attention on the kind of energy independence that renewable resources can offer. With the West trying to wean itself from Russian oil and gas, the argument for solar and wind power seemed stronger than ever.

But four months into the war, the scramble to replace Russian fossil fuels has triggered the exact opposite. As the heads of the Group of 7 industrialized nations gather in the Bavarian Alps for a meeting that was supposed to cement their commitment to the fight against climate change, fossil fuels are having a wartime resurgence, with the leaders more focused on bringing down the price of oil and gas than immediately reducing their emissions.

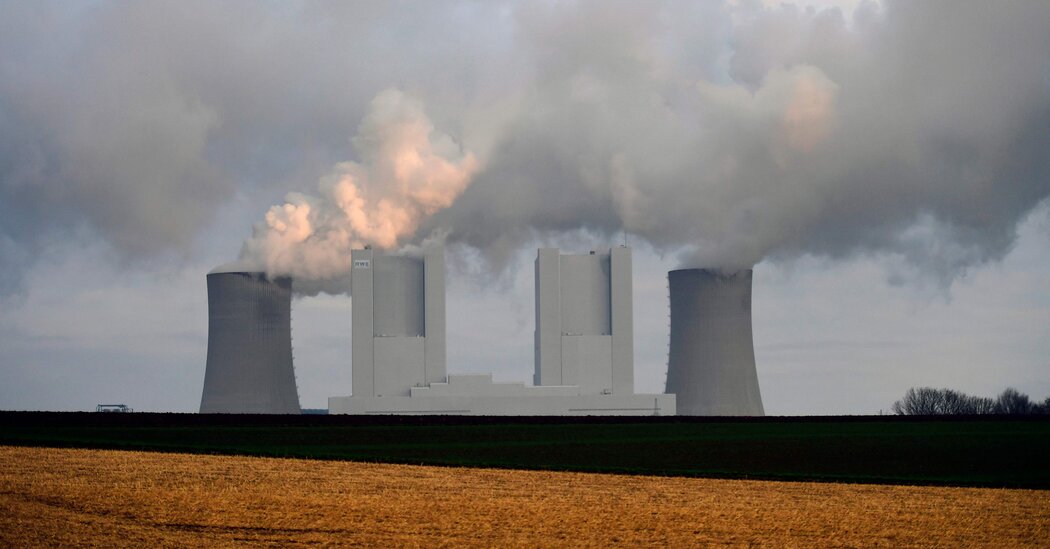

Nations are reversing plans to stop burning coal. They are scrambling for more oil and are committing billions to building terminals for liquefied natural gas, known as L.N.G.

Fossil fuel companies, long on the defensive, are capitalizing on energy security anxieties and lobbying hard for long-term infrastructure investments that risk derailing international climate targets agreed to only last year.

“That’s the battle we’re in right now,” said Jennifer Morgan, the ambassador at large for climate change in the German Foreign Ministry and a former president of Greenpeace International. “We’re in a moment of massive disruption due to the invasion, and that’s either a big risk or it’s a big opening on the climate.”

The leaders of the Group of 7 nations, including the United States and Germany, have found themselves squeezed between ambitious goals to wean themselves from fossil fuels and immediate political and economic pressures driven by the war. Those more immediate concerns will dominate much of the agenda in Bavaria, as leaders search for ways to soothe the war-inflicted spike in energy costs that has contributed to rapid global inflation and to secure supplies for the immediate future.

In a clear turnabout, Germany is lobbying fellow Group of 7 countries to scrap a joint commitment to ban public investment in overseas fossil fuel projects by the end of this year. If member states agree, it would not only make it harder to persuade the rest of the world to cut emissions and invest in renewable energy, but also endanger the declared goal of limiting global warming to 1.5 degrees Celsius, analysts warn.

Another proposal that has gained steam in recent days and is expected to feature at the summit is a price cap on Russian oil, allowing European countries to import it, but only at an artificially low price. That could help lower oil and gasoline prices worldwide and reduce the energy revenues underwriting President Vladimir V. Putin’s war efforts in Ukraine. It could also encourage more Russian oil production.

An architect of the idea, Janet L. Yellen, the U.S. Treasury secretary, has privately been telling foreign leaders that imposing the so-called price cap on Russian oil sales to Europe would be the single best thing those leaders could do right now to minimize the chances of a global recession, according to people familiar with the conversations.

Better Understand the Russia-Ukraine War

On the eve of the summit, its host, Chancellor Olaf Scholz of Germany, insisted that addressing the short-term energy crisis brought on by Russia’s war would not derail long-term climate goals.

“It is important that we discuss the situation today and at the same time ensure that we stop man-made climate change,” he said in a video posted on Saturday. “Because that’s what we have to do, by getting away from the use of fossil fuels in the long term.”

Climate activists, many of them on the streets of Bavaria protesting the summit, are not buying it.

“Instead of a massive revival in renewables, we are experiencing massive fossil backsliding,” said Luisa Neubauer, Germany’s most prominent activist in Fridays for Future, an international movement. “Germany is one of the countries that is driving this fossil backlash through both our domestic and foreign policy.”

Before Russia’s invasion in February, Group of 7 countries had made a number of climate commitments: to exit coal by 2030; to decarbonize their power sectors by 2035; to increase public investment into renewables; and to end public funding of any overseas fossil fuel projects by the end of this year.

But as the jousting over energy between Russia and Europe has escalated, the tone has changed.

This month, Russia cut by 60 percent the amount of gas it delivers via Nord Stream 1, a critical pipeline serving Germany and other countries. That prompted European governments to fire up coal plants that had been shuttered or were scheduled to be phased out.

Germany is subsidizing gasoline prices and extending the life of coal-powered electricity generators. Dutch coal plants, running at 35 percent capacity, have been authorized to ramp up to 100 percent until 2024. Austria is reactivating a coal plant mothballed in April 2020. Italy is preparing to allow a half-dozen coal-burning power plants to step up production.

In the United States, the idea of a price cap on Russian oil is seen as a way to reduce oil and gasoline prices and put a dent in the Kremlin’s finances. To date, Russia has found a way around sanctions and embargoes in the West by selling to China and India, which are gobbling up its oil at discounted — but still lucrative — prices.

The proposal would effectively allow Russia to sell more oil to Europe, but only at a steep discount on the current price of more than $100 a barrel. Ms. Yellen, as well as top economic officials in Ukraine, say it would serve two key purposes: increasing the global supply of oil to put downward pressure on oil and gasoline prices, while reducing Russia’s oil revenue.

Proponents say it is likely that Russia would continue to produce and sell oil even at a discount because it would be easier and more economical than capping wells to cut production. Simon Johnson, an economist at the Massachusetts Institute of Technology, estimates that it could be in Russia’s economic interest to continue selling oil with a price cap as low as $10 a barrel.

Some proponents say it is possible that China and India would also insist on paying the discounted price, further driving down Russian revenues.

Most worrying, analysts say, is the current scramble for gas supplies involving long-term investments in infrastructure that would make it nearly impossible to reach the goal limiting global warming to no more than 1.5 degrees Celsius.

Germany has passed legislation authorizing the construction of 12 new L.N.G. terminals and has already commissioned four floating ones.

Critics charge that building all 12 terminals would produce an excess capacity. But even half that number would produce three-quarters of the carbon emissions Germany is allowed under international agreements, according to a recent report published by a German environmental watchdog. The terminals would be in use until 2043, far too long for Germany to become carbon neutral by 2045, as pledged by Mr. Scholz’s government.

And countries are not just investing in infrastructure at home.

Last month, Mr. Scholz was in Senegal, one of the developing countries invited to the Group of 7 summit, to discuss cooperating not just on renewables but also on gas extraction and L.N.G. production.

In promoting the Senegal gas project, analysts say, Berlin is violating its own Group of 7 commitment not to offer public financing guarantees for fossil fuel projects abroad.

These contradictions have not gone unnoticed by poorer nations, which are wondering how Group of 7 countries can push for commitments to climate targets while also investing in gas production and distribution.

One explanation is a level of lobbying among fossil fuel companies not seen for years, activists say.

“It looks to me like an attempt by the oil and gas industry to end-run the Paris Agreement,” said Bill Hare of Climate Analytics, an advisory group in Berlin, referring to the landmark 2015 international treaty on climate change. “And I’m very worried they might succeed.”

Ms. Morgan in the German Foreign Ministry shares some of these concerns. “They’re doing everything that they can to move it forward, also in Africa,” she said of the industry. “They want to lock it in. Not just gas, but oil and gas and coal.”

But she and others are still hopeful that the Group of 7 can become a platform for tying climate goals to energy security.

Environmental and foreign policy analysts argue that the Group of 7 could support investments in renewable energy and energy efficiency, while pledging funds for poorer nations hit with the brunt of climate disasters.

Above all, activists warn, rich countries need to resist the temptation to react to the short-term energy shortages by once again betting on fossil fuel infrastructure.

“All the arguments are on the table now,” said Ms. Neubauer, the Fridays for Future activist. “We know exactly what fossil fuels do to the climate. We also know very well that Putin is not the only autocrat in the world. We know that no democracy can be truly free and secure as long as it depends on fossil fuel imports.”

Katrin Bennhold Bennhold reported from Berlin, and Jim Tankersley from Telfs, Austria. Erika Solomon and Christopher F. Schuetze contributed reporting from Berlin.