(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Most Read from Bloomberg

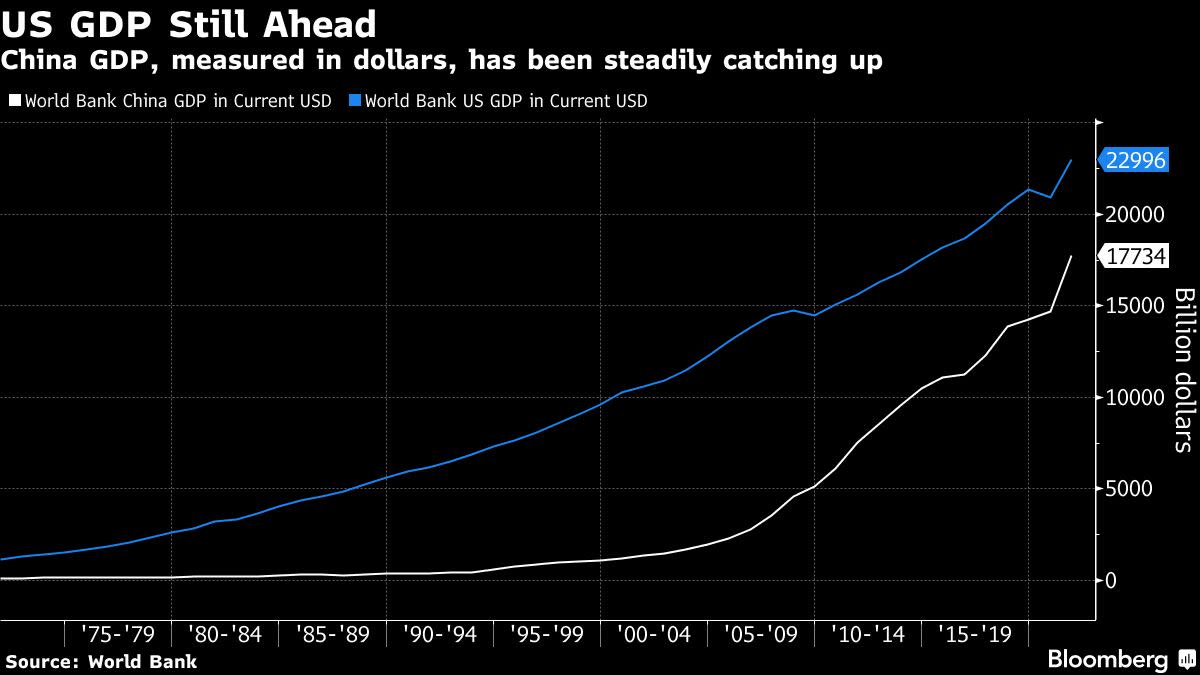

Former Treasury Secretary Lawrence Summers said that predictions for the size of China’s economy to exceed that of the US have parallels to failed historical calls for Japan and Russia to do the same thing.

“It was taken as axiomatic six months or a year ago that at some point the Chinese would surpass the American economy in terms of total GDP at market exchange rates,” Summers told Bloomberg Television’s “Wall Street Week” with David Westin. “That’s now much less clear.”

The latest monthly economic data for China showed retail sales, industrial output and investment all slowed and missed economists’ estimates in July. Goldman Sachs Group Inc. is among those cutting growth forecasts, and it now sees gross domestic product rising 3% this year — well under the 5.5% target that President Xi Jinping’s government set in March but has now effectively abandoned.

“People are going to look back at some of the economic forecasts about China in 2020 in the same way they looked back at economic forecasts for Russia that were made in 1960 or for Japan that were made in 1990,” said Summers, a Harvard University professor and paid contributor to Bloomberg Television.

Summers listed “all kinds” of challenges for China going forward, including:

-

A “huge” financial overhang

-

Lack of clarity on what dynamics will propel future growth

-

The “growing Communist Party involvement in a wider range of enterprises”

-

Demographic patterns that are seeing China’s working-age population shrink and its ranks of elderly growing as a share of the total population

Meantime, China’s current slowdown “probably will” give some relief for the US in terms of inflation, in particular through its effect on commodity prices, Summers said.

The former Treasury chief reiterated his call for Federal Reserve policy makers not to be lulled into thinking that decelerating headline inflation — thanks to oil and commodity-price declines — means that the inflation challenge is subsiding.

Summers said that US inflation expectations — which show confidence in price gains returning toward 2% over the longer haul — have been propelled by oil and commodity-price declines. But core measures of inflation aren’t showing progress, he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.