Data: FactSet; Chart: Axios Visuals

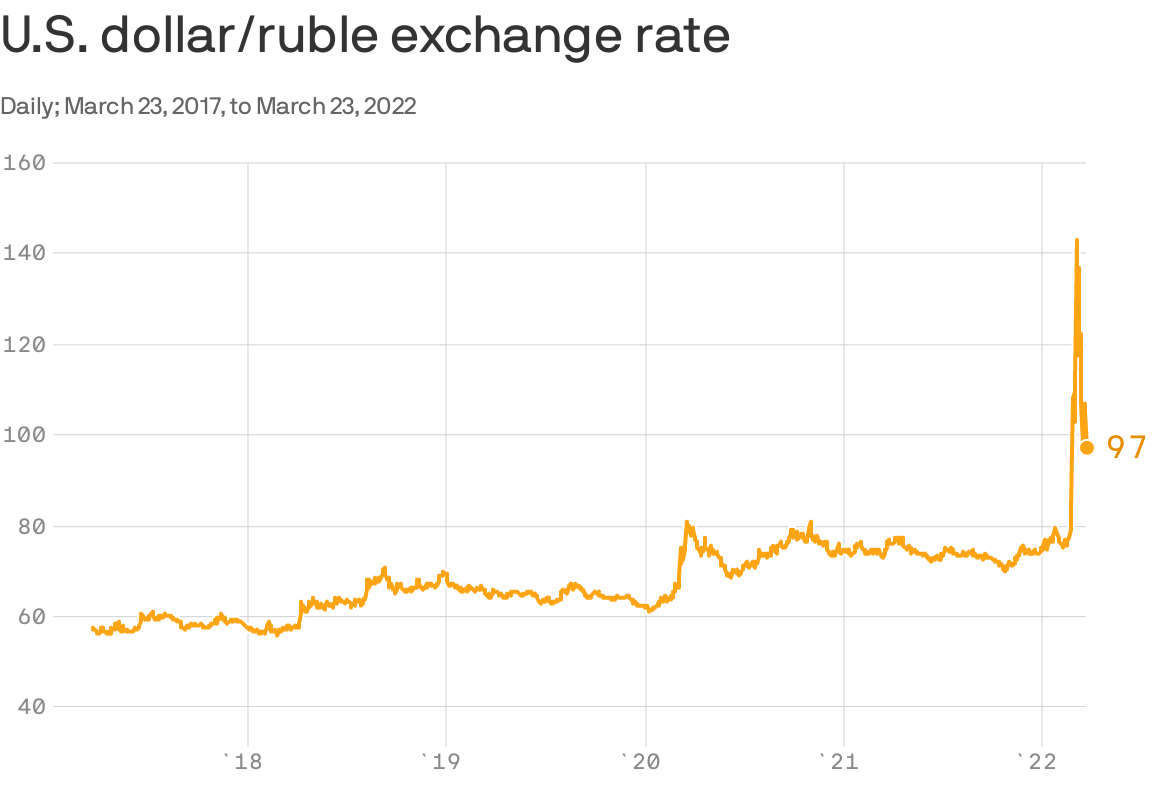

Russia’s ruble has rebounded sharply in recent weeks, as officials cobbled together an unorthodox defense of the currency after it collapsed from Western sanctions over Moscow’s invasion of Ukraine.

Driving the news: The latest effort to shore up support came in the form of a direct demand from President Vladimir Putin that Europe — or as he put it, “unfriendly countries” — pay for Russian natural gas using rubles, rather than dollars or euros.

Get market news worthy of your time with Axios Markets. Subscribe for free.

State of play: Sanctions imposed after the invasion of Ukraine have hammered the value of the ruble, vaporizing roughly 90% of its value against the dollar at times this year.

-

The government took measures — like raising interest rates, halting currency trading, and demanding Russian companies exchange their foreign earnings for rubles — that slowed and ultimately stabilized the currency.

Yes, but: Putin’s latest gambit has already been labeled a breach of contract by German officials. If it prompts full rupture with Europe, which buys 40% of its gas from Russia, the ruble will likely fall again.

-

Yes, but, but: Such a break would also make Europe’s energy crisis much worse. European natural gas prices surged 30% after Putin made his demand.

Go deeper: Russia’s economic long game

More from Axios: Sign up to get the latest market trends with Axios Markets. Subscribe for free