NerdWallet Budgeting App

Product Title: NerdWallet Budgeting App

Product Description: NerdWallet provides a free budgeting app that’s out there to anybody who registers for an account. It has all the essential options of a budgeting app however lacks a number of niceties, like splitting transactions and notifications.

Abstract

NerdWallet’s budgeting options allow you to observe your spending, credit score rating, and web price. It’s free to make use of, however you’ll see suggestions for merchandise which are actually simply adverts in disguise.

Execs

- Free

- Stable monitoring options for spending

- Tracks credit score rating

- Tracks networth

Cons

- Not a real budgeting app

- Advertisements

- No customized notifications

- No customized expense classes

- Can’t cut up transactions

Nerdwallet’s budgeting app is a part of a collection of instruments out there everytime you register for an account on their website. It’s a lesser-advertised profit.

Along with budgeting and monitoring your web price, you can too get your credit score rating based mostly in your TransUnion credit score report. Not unhealthy for a free app.

📔 Fast Abstract: Should you register an account on NerdWallet, you may get free entry to their fundamental budgeting and web price monitoring device in addition to a free credit score rating based mostly in your TransUnion credit score report. It’s not a really complicated device however for those who simply wish to control your transactions, spending classes, and payments – it is likely to be a very good choice for many who don’t wish to pay. It’s our favourite of the fully free budgeting apps.

At a Look

- Free

- Extra of a monetary tracker than a budgeting device

- Cell centered, restricted internet entry

- Advert heavy

Who Ought to Use NerdWallet’s Budgeting App

If you’re new to budgeting, or have tried extra difficult budgeting apps and gotten annoyed, NerdWallet’s budgeting app is likely to be a very good match. It’s not a budgeting app, as a lot as it’s a spending tracker. That is good for many who aren’t nice at maintaining with their funds and actually simply wish to understand how they spent their cash up to now.

Nevertheless, if you would like a real budgeting app, the place you may set classes and observe your spending in opposition to your objectives, then NerdWallet won’t be for you.

NerdWallet Alternate options

Desk of Contents

- At a Look

- Who Ought to Use NerdWallet’s Budgeting App

- NerdWallet Alternate options

- Signing up for NerdWallet

- Money Move Monitoring

- 50/30/20 Price range Tracker

- Internet Price Monitoring

- NerdWallet Cell App

- NerdWallet as a Budgeting Instrument

- Is It Price It?

- NerdWallet Budgeting App Alternate options

- Backside Line

Signing up for NerdWallet

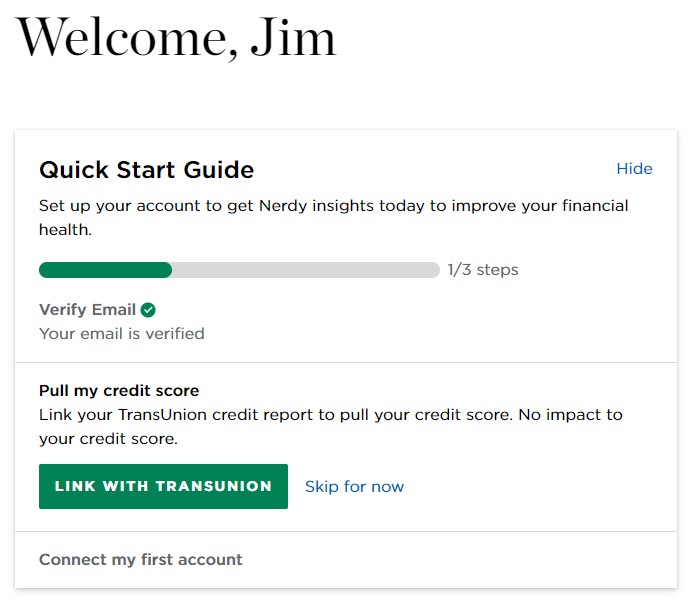

When you register for an account, you’re prompted to complete two extra steps:

- Pull your credit score rating

- Join your first account

I don’t actually care about my TransUnion credit score rating proper now, however proper under that picture is “Your key numbers” and two intriguing bins:

Earlier than you should use any of these options, they need extra info to allow them to improve their safety. They ask one safety query after which need you to confirm your cellphone quantity. That is in all probability a requirement for Plaid, what they use to hyperlink your accounts, and also you at all times need two-factor authentication for stuff like this.

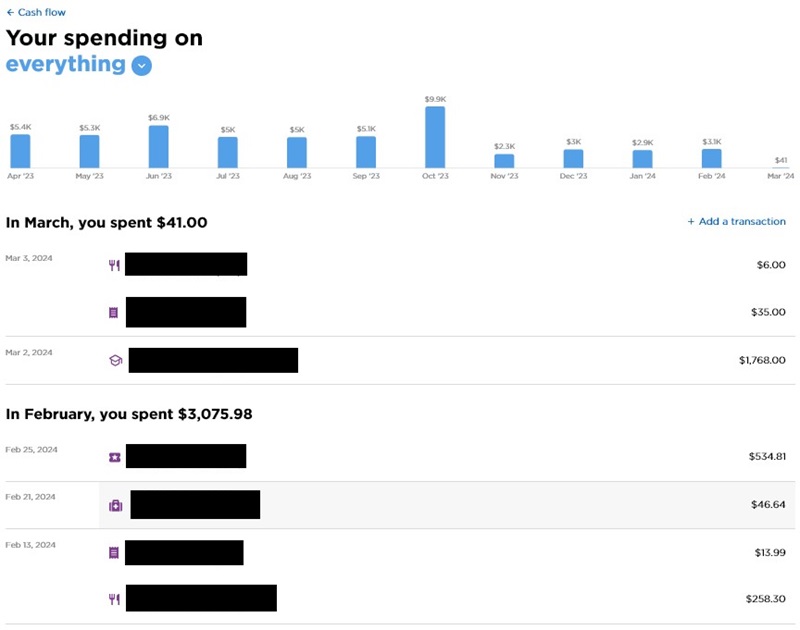

Money Move Monitoring

Utilizing Plaid, I linked our Chase bank cards to see what sort of budgeting options they might provide. NerdWallet desires your account numbers (Chase provides them “substitutes” that aren’t your precise numbers), account names, balances, transactions, rewards, and phone info.

I provided up the primary bank card we use, the Chase Sapphire Most popular card. By the way, you probably have a number of logins to a single establishment, you may solely use one. For instance, you probably have a login on your financial institution and your accomplice does too (to a separate account), you may’t log into each accounts.

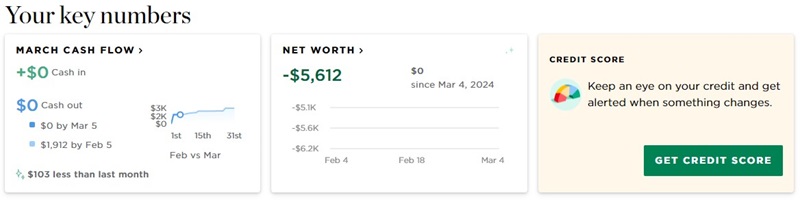

These three bins up to date to indicate this:

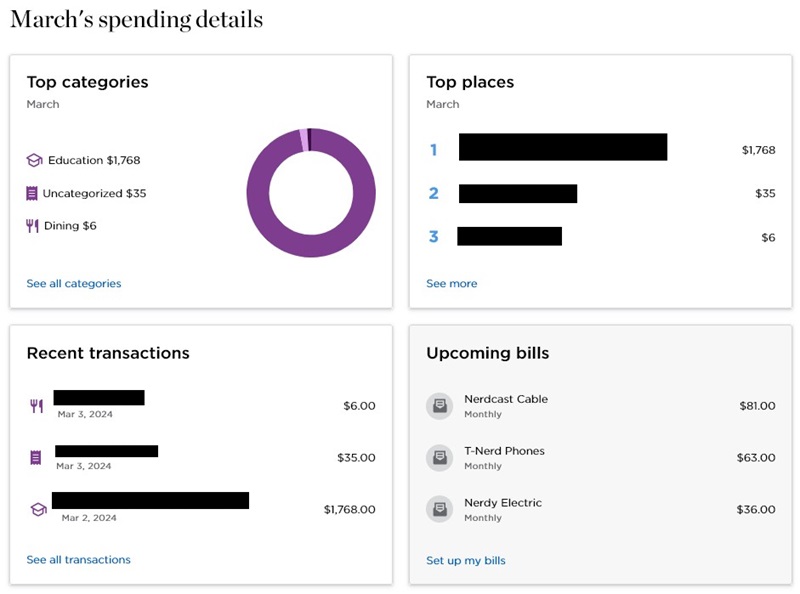

Should you click on via, you get the forms of belongings you’d anticipate:

The fascinating information is within the Latest Transactions:

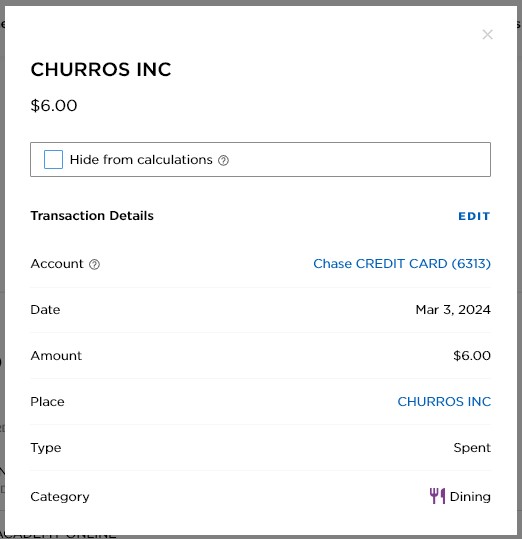

If you’re utilizing the cell app, you may click on on a transaction, you may edit a variety of the main points. This may not be finished on the web site.

The budgeting options are comparatively fundamental, with a number of minor considerations.

You can not cut up a transaction into a number of classes. You may edit the worth decrease after which add one other transaction, which is a number of additional steps.

Should you obtained paid again for a shared expense, you may add a transaction for that, however there’s no method to hyperlink it to the unique expense.

Should you edit a transaction’s class, it doesn’t know to edit the opposite transactions from that very same vendor to the brand new class. For probably the most half, it will get a lot of the classes proper.

Relying on how specific you want your classes, they could be a little broad. And you’ll’t add customized classes. What you see is what you get.

Lastly, you may’t manually add a transaction for the long run, it’ll default to the present date.

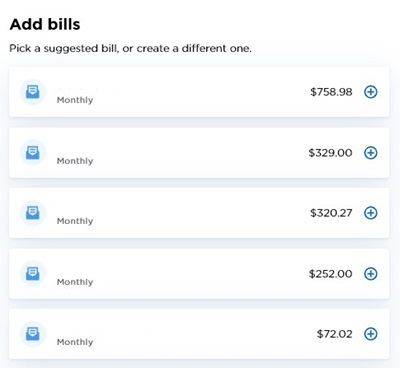

Upcoming Payments

To make use of the upcoming payments function, it’s a must to add every invoice your self. NerdWallet will examine for recurring prices and recommend ones that is likely to be recurring nevertheless it at all times means that it’s a month-to-month cadence.

Should you click on the Plus signal, you may add it after modifying the main points. You may change the identify, quantity, subsequent due date, frequency, invoice class, and subcategory. For frequency, you may decide weekly, each different week, month-to-month, each different month, each 3 months, each 6 months, yearly, or one-time.

Whenever you’re finished, scroll all the way down to the “Add X Bills” button to put it aside. Should you X out the window, it gained’t save.

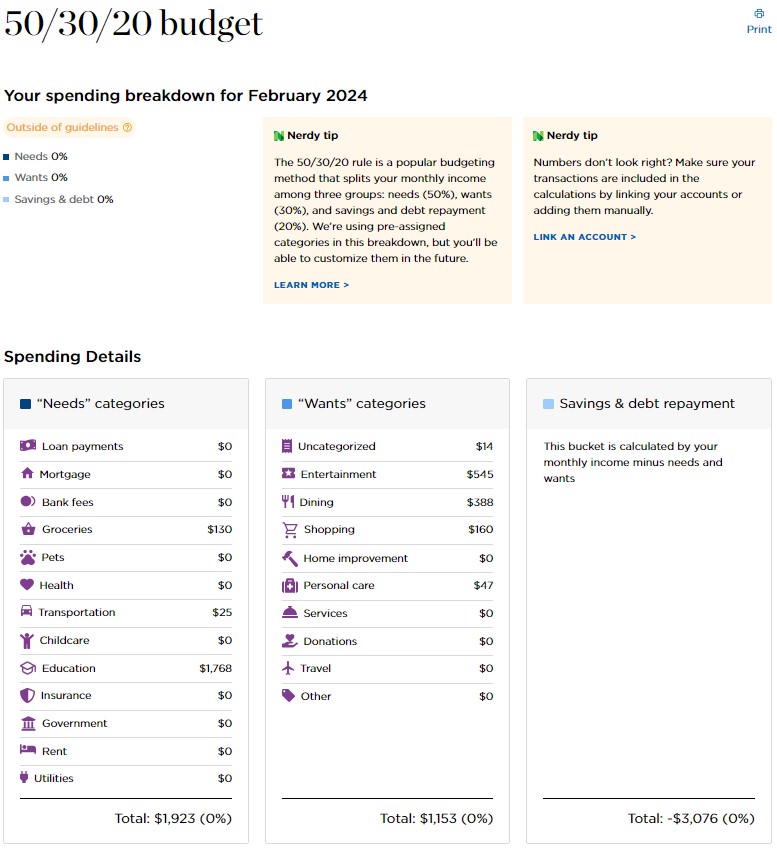

50/30/20 Price range Tracker

Do you observe the 50/30/20 funds? That’s the place you spend 50% on wants, 30% on desires, and 20% on financial savings and debt reimbursement?

If that’s the case, that’s constructed into the cell app. You will get a report every month to see how shut you matched these percentages.

It’s nonetheless in beta however finally they may allow you to transfer issues across the columns:

The one philosophical gripe you may have with that is that the precept behind the 50-30-20 funds is that you simply put aside 20% for financial savings and debt reimbursement first.

They calculate it as what’s left over in any case the opposite bills. It’s because financial savings and debt reimbursement aren’t linked to particular transaction classes. This may very well be fastened in the event that they made a particular class for it, in order that you can “pay yourself first.”

Internet Price Monitoring

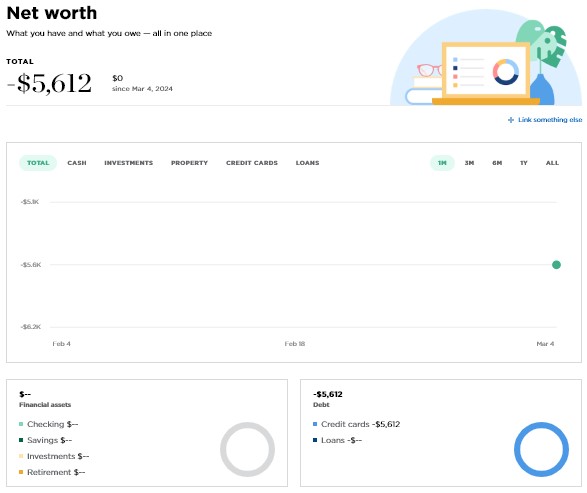

Since I used to be largely within the budgeting options, I didn’t undergo the hassle of including any funding accounts so the Internet Price web page appears barren:

I think this a part of the device isn’t going to be tremendous refined and even after including a number of handbook accounts, with dummy info, what you see is what you get. It collects information and tracks it, just like what you may get from Empower Private Dashboard, however not a lot in the way in which of breakdowns and evaluation past what categorization.

They might increase this later however proper now it’s rudimentary.

NerdWallet Cell App

NerdWallet is shifting this device to the cell app and lowering the options out there on the web site.

The app is a handy method to entry your account out of your cellphone, with out having to go to the web site to do it. The one main distinction is the addition of a Market, which is the place you’ll find totally different merchandise (and join NerdWallet+)

Having the app additionally provides you the choice to choose into push notifications.

You will get push notifications for money stream – resembling “spending updates for large transactions, fees, deposits, and more.” I couldn’t discover a method to arrange notifications

NerdWallet’s budgeting device isn’t a lot a budgeting device as it’s a spending tracker. Should you simply wish to pull studies and see the way you spent your cash up to now, then NerdWallet might be helpful.

Nevertheless, if you wish to plan your spending forward of time, you’ll discover this device missing. You may’t create classes and plan spending like you may in most different budgeting apps. For instance, you may’t set a “Restaurant” class after which observe your spending in opposition to it, so that you solely spend what you have got budgeted.

Is It Price It?

Contemplating it’s free, they do provide a variety of the essential options you had been getting with Mint (however you can not import transactions).

The lack to separate transactions is one massive distinction however there’s additionally no method to pressure a sync of your accounts. They will be synched as soon as a day at no matter cadence NerdWallet has labored out with Plaid. I think that is to assist maintain prices low, which is totally cheap.

Should you have a look at critiques on-line, you’ll hear that some individuals have had issue linking up totally different accounts, however that’s possible a Plaid difficulty and never a NerdWallet one. Should you’ve had points with Plaid and your establishments up to now, you’ll have those self same points right here.

NerdWallet Budgeting App Alternate options

YNAB

YNAB is a real budgeting app with an enormous following. With YNAB, you create classes and fund these classes as earnings arrives. You’ll then observe your spending in opposition to the classes so that you at all times know the place you stand.

It really works on the precept of “living on last month’s income” and helps you get there by encouraging you to fund subsequent month’s classes when potential, thus breaking the paycheck-to-paycheck cycle.

Right here’s our full YNAB evaluate for extra info.

Lunch Cash

Lunch Cash is one other true budgeting app. You may arrange classes in your funds and point out how a lot you’ll spend in every class. As transactions are available in, you’ll categorize them and you may see precisely how a lot you’ve spent thus far in every class and examine it to your objectives.

It’s declare to fame is that it might probably simply deal with a number of currencies. So for those who journey steadily, or receives a commission in a distinct forex than you spend in, this app can deal with that with no points.

Right here’s our full Lunch Cash evaluate for extra info.

Simplifi

Simplifi is Quicken’s budgeting app. It’s easier than both YNAB or Lunch Cash, however offers extra budgeting options than NerdWallet’s. So if you would like one thing with extra options than NerdWallet provides, however aren’t able to dive right into a full budgeting system, Simplifi is likely to be for you.

You may set classes every month and observe your spending in opposition to them nevertheless it’s not a function wealthy as YNAB or Lunch Cash.

Right here’s our full evaluate of Simplifi for extra info

Backside Line

If you need a fundamental budgeting app, NerdWallet has a very good product at an awesome worth. If you need slightly extra, there are a number of paid budgeting apps that at the moment provide much more options and reporting capabilities. A number of people had been in search of options to Mint, because it shut down in March of 2024, and NerdWallet is likely to be a very good choice although you can not import your information.

Should you do have a budgeting to pay for a service, the paid companies that appear to get probably the most reward are Simplifi by Quicken and Monarch Cash.

If budgeting is essential however not the first function you’re after, I’d suggest Empower Private Dashboard. It’s budgeting capabilities are related however the web price monitoring and retirement planning is stronger.