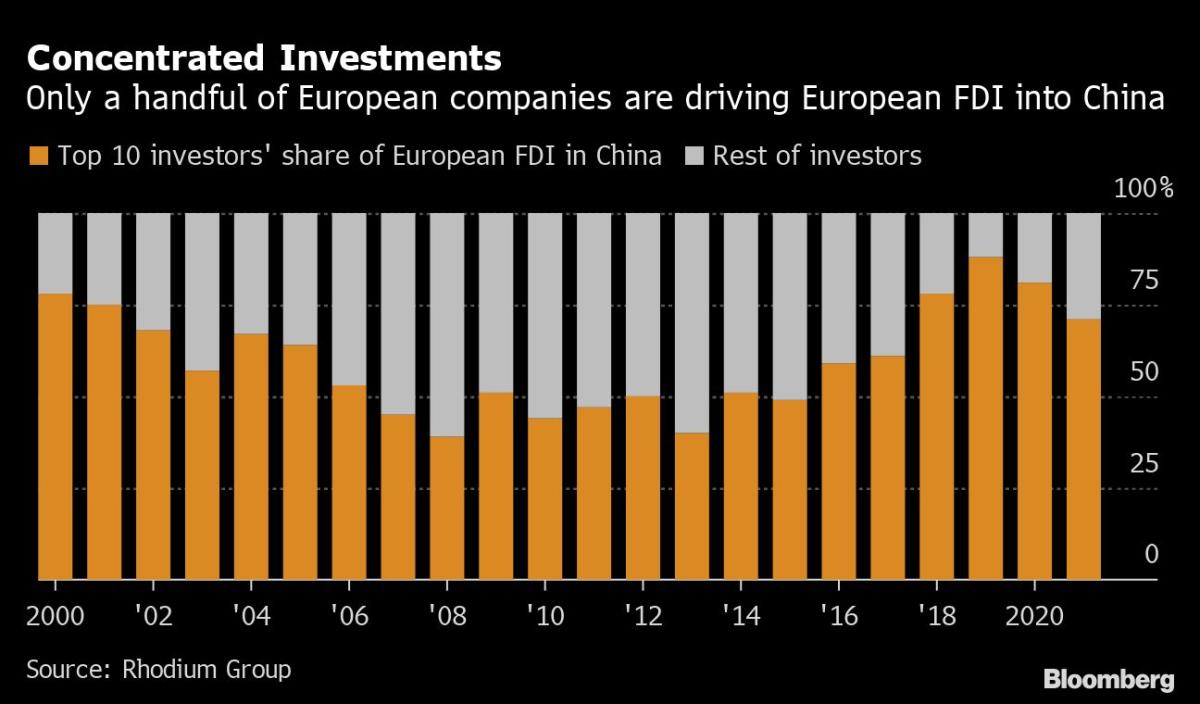

(Bloomberg) — European investments in China have grown increasingly concentrated around a handful of large corporations, most of them German, according to a study by Rhodium Group.

Most Read from Bloomberg

From 2018 through 2021, the top 10 European companies investing in China made up nearly 80%, on average, of total investments from the continent, the report published Thursday showed. German businesses contributed more than two-fifths of the money pouring into the world’s second-largest economy from Europe.

Underlining how concentrated the cash flows have become, carmakers Volkswagen AG, BMW AG, and Daimler AG and chemicals group BASF SE accounted for a third of investments during the past four years, researchers Agatha Kratz, Noah Barkin, and Lauren Dudley wrote.

“Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market,” they said. “As policy makers in Berlin and other European capitals consider measures to reduce economic dependence on China, they would be wise to take the growing concentration of corporate risks into account.”

Corporate Europe’s relationship with China has received increased attention this year after the war in Ukraine exposed the continent’s vulnerabilities in doing business with Russia. In a sign of growing political scrutiny, Germany’s government refused to renew VW’s risk insurance to cover some investments in China because of concerns over possible indirect ties to human-rights violations in Xinjiang province.

The pandemic has slowed the overall pace of investments, with restrictive Covid policies and challenging market conditions deterring many foreign businesses from building out their Chinese operations. Virtually no new European firms have chosen to enter the Chinese market in recent years, Rhodium said.

Big players with an existing China presence have continued to invest. Just last week, BASF celebrated the launch of a new 10 billion-euro ($10 billion) mega complex in Zhanjiang, featuring the participation of Politburo Standing Committee member and Executive Vice Premier Han Zheng.

Analysts at consultancy Trivium China in Beijing called the high-level involvement “rare,” saying it signals the government wants to drum up more foreign investments.

Rhodium said it’s unclear whether a phase-out of pandemic policies will encourage new businesses to enter the Chinese market and reverse the concentration trend.

“It is also possible, perhaps even probable, that the concentration of European investment in China around a small number of well established European firms whose presence is welcomed by the Chinese authorities becomes more entrenched,” according to the report.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.