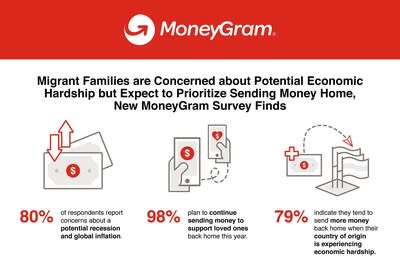

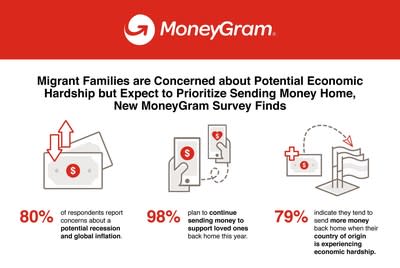

Over 80% of respondents report concerns about a potential recession and global inflation, but 98% plan to continue sending money to support loved ones back home this year

79% indicate they tend to send more money back home when their country of origin is experiencing economic hardship, further evidenced by MoneyGram’s internal data on recent sends to both Ukraine and Afghanistan

New findings released for International Day of Family Remittances highlight the financial resilience of migrants who transfer funds to loved ones to pay for life’s essentials

DALLAS, June 16, 2022 /PRNewswire/ — MoneyGram International, Inc. (NASDAQ: MGI), a global leader in the evolution of digital P2P payments, today released the findings of a new customer survey detailing trends around how families in the United States are transferring money around the world this year. These new findings are being released on the United Nations’ International Day of Family Remittances, a global holiday celebrated annually on June 16.

Migrant families are concerned about potential economic hardship but expect to prioritize sending money home this year.

Results of the survey demonstrate respondents remain resilient, as they have concerns over the economy but expect to continue sending money to support loved ones. Over 80% of respondents report concerns about a potential recession and global inflation, but the overwhelming majority (98%) say they plan to continue sending money back home throughout the rest of the year.

Additionally, more than three-quarters (79%) indicate they tend to send more money back home when their country of origin is experiencing economic hardship. This is further evidenced by MoneyGram’s internal data, which shows a 41% spike in sends from the U.S. to Ukraine in March 2022 compared to the same month the prior year, as well as a steady increase in global sends to Afghanistan in the last year.

“We’re on a mission to deliver innovative financial solutions to connect the world’s communities, and our services are incredibly important at a time like this,” said Alex Holmes, MoneyGram Chairman and CEO. “If the current economic volatility leads to prolonged economic hardship, we expect consumers will likely cut expenses in other areas to prioritize their families. These survey results underscore the dedication people have to their loved ones abroad, and I continue to be inspired by our customers.”

Many are sending cross-border money transfers to their siblings, friends, and parents to pay for basic essentials such as food, housing, and healthcare.

When asked who respondents are sending to this year, primary recipients include siblings (49%), friends (48%), and parents (38%). Survey data also highlights that cross-border money transfers continue to be used to fund the basic essentials of life for people around the world. The top four expenses respondents help cover for recipients are food (72%), housing (55%), healthcare (52%), and emergencies (44%).

Interestingly, among global concerns around high fuel prices and supply chain issues impacting the availability of vehicles, nearly a quarter (22%) of respondents indicate their cross-border money transfers have gone toward transportation expenses.

Reasons for migration to the United States include employment opportunities, educational purposes, and reunions with families.

International Day of Family Remittances recognizes the contributions made by the more than 200 million migrants to improve the lives of their 800 million family members and friends back home. For respondents born outside of the United States, the survey finds that the main reason for moving to the U.S. was for employment opportunities (57%), followed by educational purposes (39%), and reunions with families (35%).

“In times of rising costs, it’s even more important to offer consumers affordable options. We’ve worked hard to modernize our operations to reduce our cost structure, and as a result, our average cost for consumers globally is approximately 2.9%, which is already below UN Sustainable Development Goals to reduce costs of remittances to less than 3% by 2030,” Holmes concluded. “We are extremely proud of the customer-centric platform we’ve built, and the key role MoneyGram plays in serving families.”

Survey Methodology

This poll was conducted between June 1 and June 6, 2022, among a group of more than 2,500 MoneyGram customers based in the United States. The survey was created by MoneyGram and conducted through an online survey platform. Participation was voluntary, and respondents were not compensated.

About MoneyGram International, Inc.

MoneyGram International, Inc. (NASDAQ: MGI), a global leader in the evolution of digital P2P payments, delivers innovative financial solutions to connect the world’s communities. With a purpose-driven strategy to mobilize the movement of money, a strong culture of fintech innovation, and leading customer-centric capabilities, MoneyGram has grown to serve over 150 million people in the last five years. The Company leverages its modern, mobile, and API-driven platform and collaborates with the world’s top brands to serve consumers through its direct-to-consumer digital channel, global retail network, and embedded finance business for enterprise customers. MoneyGram is also a leader in pioneering cross-border payment innovation and blockchain-enabled settlement. For more information, please visit ir.moneygram.com, follow @MoneyGram on social media, and explore the website and mobile app through moneygram.com.

Media Contact

Sydney Schoolfield

media@moneygram.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/migrant-families-are-concerned-about-potential-economic-hardship-but-expect-to-prioritize-sending-money-home-new-moneygram-survey-finds-301569621.html

SOURCE MoneyGram