(Bloomberg) — Giorgia Meloni’s euphoria at winning the Italian election is running into reality as the far-right leader struggles to put together a coalition government and the gas-dependent country’s financial outlook darkens.

Most Read from Bloomberg

The Brothers of Italy head, who has failed to find a finance minister since her Sept. 25 victory, will likely preside over a declining economy in her first year in office, with a recession looming in the coming quarters, according to the IMF.

“We are projecting a very sharp slowdown for next year,” the fund’s chief economist, Pierre-Olivier Gourinchas, told a news conference in Washington. “In large part this is due to energy prices and the dependence that Italy has on gas. We’re also seeing the impact of the tightening of monetary policy in the euro area and also weak external demand.”

The currency bloc’s third-biggest economy is expected to shrink by 0.2% next year, one of only two members facing a contraction in output, alongside Germany, which has also long been dependent on Russian fossil fuel.

The projection — far more pessimistic than one issued by the OECD club of rich nations a day after the election of her right-wing coalition — illustrates the challenges Meloni will face as she tries to create a government.

The clock is ticking.

The new parliament holds its first session on Thursday with Mario Draghi still caretaker prime minister. Italy submitted a draft budget plan to the European Union on Monday, giving Meloni about a month to update it with her policy plans. Parliament needs to approve it by year-end.

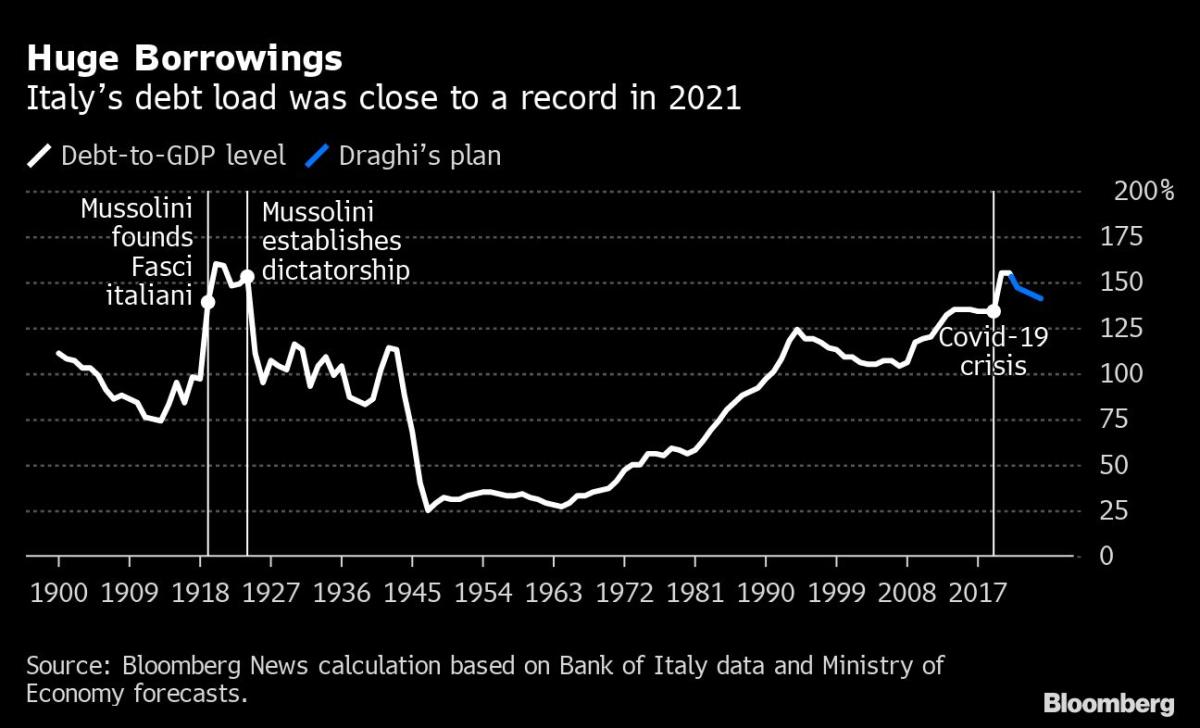

Until now, she has struggled to recruit a finance minister who can offer credibility to financial markets and reassure investors that Italy’s mammoth debt of 145% of output can be sustainably managed, in the vein of incumbent Daniele Franco and his boss, Draghi.

“There’s a general lack of quality in Italy’s ruling class and it’s more evident on the right, a part of which hasn’t had the experience of governing,” said Giovanni Orsina, director of the School of Government at Luiss-Guido Carli University in Rome. He said finding a high-level person with the right skills who can pacify her coalition partners and shares her ideas is difficult.

Potential top candidate Fabio Panetta, a member of the European Central Bank’s Executive Board, is out of the running and no other candidate has yet emerged as a clear choice for the post, though the chances of Meloni appointing a politician like the League’s Giancarlo Giorgetti are rising, according to Italian media.

Adding to Meloni’s woes, Ecological Transition Minister Roberto Cingolani, who has played a key role in helping Italy through the energy crisis, told reporters on Tuesday he is not available to remain in the post with a new government.

Italy’s president will start talks with all party leaders once parliament is in place, which will lead to the appointment of Meloni as premier designate. She will have to present a list of ministers to be approved by the president and subsequently by parliament.

This will give insight into both her policy plans and how much power will be granted to each member of the coalition, which includes Matteo Salvini’s League and ex-Premier Silvio Berlusconi’s Forza Italia.

She will then take on the daunting task of navigating the country through an energy crisis, an economic slowdown, and the double hit of inflation and rising interest rates that will squeeze her fiscal firepower.

Italian 10-year yields have more than quadrupled this year, climbing to about 4.7%, with the spread between Italian and German debt widening to almost 240 basis points. The ECB is poised to raise interest rates again this month.

Sources close to Meloni said she is well aware of the lessons to be drawn from UK Prime Minister Liz Truss’ run-in with markets after the presentation of her government’s mini-budget last month, and aims to run the economy with a steady hand and avoid potentially disruptive internal rivalries.

JP Morgan Securities analyst Marco Protopapa said in a note to clients that “significant policy uncertainty lurking in the background” was among concerns. He expects Italy entered a contraction around the end of the summer that will intensify through the fourth quarter as high energy prices depress household spending.

On the bright side, Italy’s economy performed better than expected last year and is still seen growing this year overall, partly boosted by tourism and construction. Industrial production unexpectedly jumped 2.3% in August, and Draghi left Meloni a 9 billion-euro ($8.8 billion) spending cushion.

And if Italy’s new leader needs advice, the deputy director of the IMF’s research department, Petya Koeva Brooks, had a simple message: “Focus on providing support to the most vulnerable.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.