(Bloomberg) — It may be hard to imagine that ESG, now a hotly debated topic in American politics, traces its roots back to a former UK tabloid reporter and a 45-minute meeting in a fifth-floor office in Geneva.There, he and a small team of United Nations staffers coined in 2004 what’s now become one of the most controversial acronyms in finance. Their aim was to get investors and bankers to weigh key risks such as the earth’s rising temperatures, labor disputes and corporate malfeasance, and determine their impact on profits. Using the language of the capital markets — risks and opportunities — ESG was meant to pivot away from socially responsible investing and appeal to Wall Street.But then ESG morphed into a label that was everywhere, and it came to mean different things to different people. The three letters were added to stock funds, bond issues, corporate ratings and Wall Street derivatives worth trillions of dollars, creating confusion and disagreement that left the acronym vulnerable to attack.

Most Read from Bloomberg

First, industry insiders criticized environmental, social and governance investing claims for being little more than a marketing gimmick. Regulators were next to crack down on money managers making hollow claims. And then the Republican onslaught began, with US presidential hopefuls saying ESG is something peddled by “left-wing radicals,” while states including Florida pulled money from BlackRock Inc., Wall Street’s biggest ESG proponent. With the backlash reaching fever pitch, sustainable investors called for a course correction. Others sounded the death knell for the acronym.Bemused by the assault is Paul Clements-Hunt, who led the UN team that created the ESG label more than 18 years ago. He said the attacks on their invention are in fact a “good thing.” Rather than being upset, he said he’s decided to “relax and enjoy the warring parties attack and defend ESG in equal measure.”“It was giving the concept huge amounts of free airtime,” Clements-Hunt, 57, said in an interview.

Clements-Hunt wants the world to understand that ESG is a quintessentially capitalist concept. Capitalism has survived the past 250 years by adapting to the times, and the next phase requires it to price in the risks that ESG issues represent, he said.

The more the debate plays out, the more obvious it will be that “extractive capitalism,” where growth relies on tapping limited resources, can’t compete with “regenerative capitalism,” which pegs economic success to growth that can be sustained, said Clements-Hunt, who’s now a sustainability director at UK law firm Mishcon de Reya LLP.

Read more…

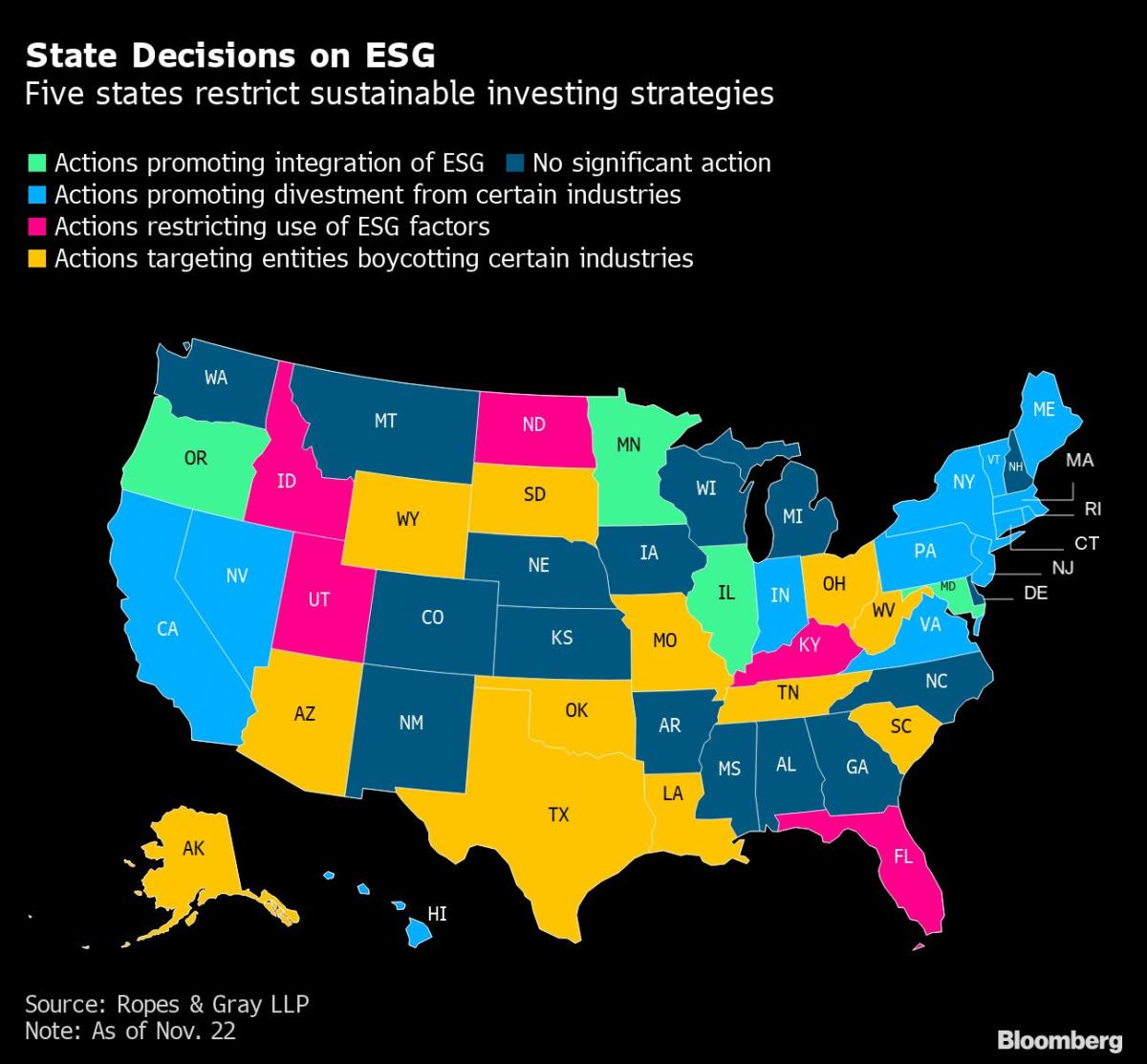

GOP politicians plan to ratchet up their ESG attacks in the coming months with House Republicans set to hold congressional hearings. Separately, a number of anti-ESG bills will soon be introduced in states across the country.After Texas officials accused financial firms of boycotting oil and gas companies, Clements-Hunt said ESG isn’t about “saving the world.” It’s also the “antithesis” of divesting from industries such as fossil fuels, he added. Instead of being shunned, oil and gas companies need to be included in the debate because they understand how to deliver global energy at scale and have the balance sheets capable of enabling the transition to clean energy, he said.

The intention of ESG is to preserve profits, make money from things like renewable energy and avoid losses from corporate governance lapses that led to the bankruptcy of crypto exchange FTX, the current struggles at Credit Suisse Group AG and the diesel-emissions cheating scandal at Volkswagen AG from several years ago, he said.“Stripping away the white noise and politics, ESG is simply a way to manage new and evolving risks as a result of policy changes, and mitigate them where you can,” he said.And while the GOP accuses ESG of being a socialist conspiracy, Clements-Hunt said it’s the Republicans who now seem to be embracing something akin to central planning. “That’s the irony of all this,” he said. “Once politicians tell business and markets that they can’t consider risks, that’s undermining the very basics of how the capitalistic system works.”

Clements-Hunt has described himself as a “card-carrying capitalist.’’ While he’s never managed large amounts of money for others, he has advised large investment firms and allocated his own funds to startup companies, according to his online bio. He’s also advised former UK Prime Minister Gordon Brown on sustainable development. Clements-Hunt started out as a reporter in the late 1980s and wrote for British newspapers, including tabloids such as the Sun.

Earlier this year, he criticized the finance industry for sprinkling “ESG fairy dust” on products such as index funds, and predicted an industry shakeout in the coming years. And while skeptics have said it’s time to retire the ESG label because of the backlash, Clements-Hunt said doing so won’t remove the risks that businesses face from things like climate change.

Others have argued for the ESG acronym to be broken apart so that environmental, social and governance issues can be tackled separately. But the strength of ESG, Clements-Hunt said, isn’t the individual topics, it’s them working together.“They come as a package,’’ he said. “It’s not E and S and G. It’s ESG.”

Clements-Hunt said he doesn’t see the “cage fighting’’ going away anytime soon — at least before the 2024 US presidential election. Still, there will be greater clarity surrounding the label thanks to efforts by industry groups that are setting new standards for ESG claims, he said.“If you thought ESG was mainstream at the beginning of the year, now it really is mainstream because people who had never even heard of it before are talking about it,’’ he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.