(Bloomberg) — European Commission President Ursula von der Leyen will call for radical steps to stem the energy crisis, edging closer to rationing measures and calling for a swoop on energy companies’ profits.

Most Read from Bloomberg

The proposals she will set out in a speech before the European Parliament on Wednesday will intensify the fractious discussions between member states, which have different priorities and vulnerabilities. She’s already had to park the idea of imposing a price cap on imported Russian gas amid opposition and divisions.

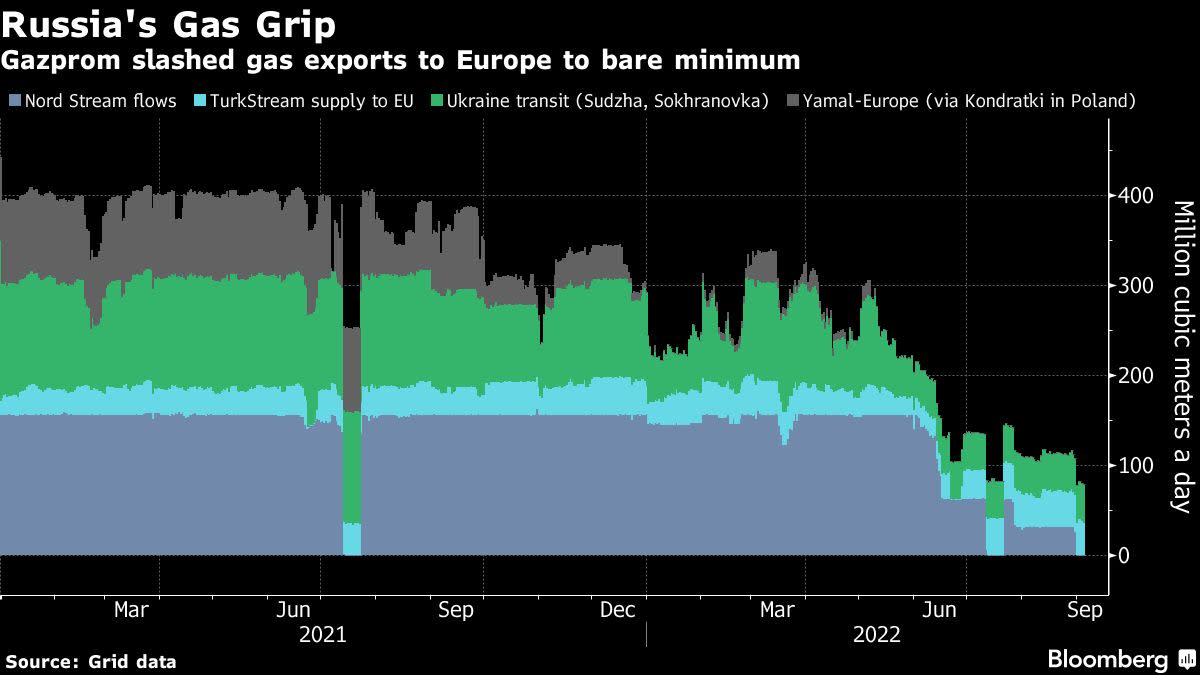

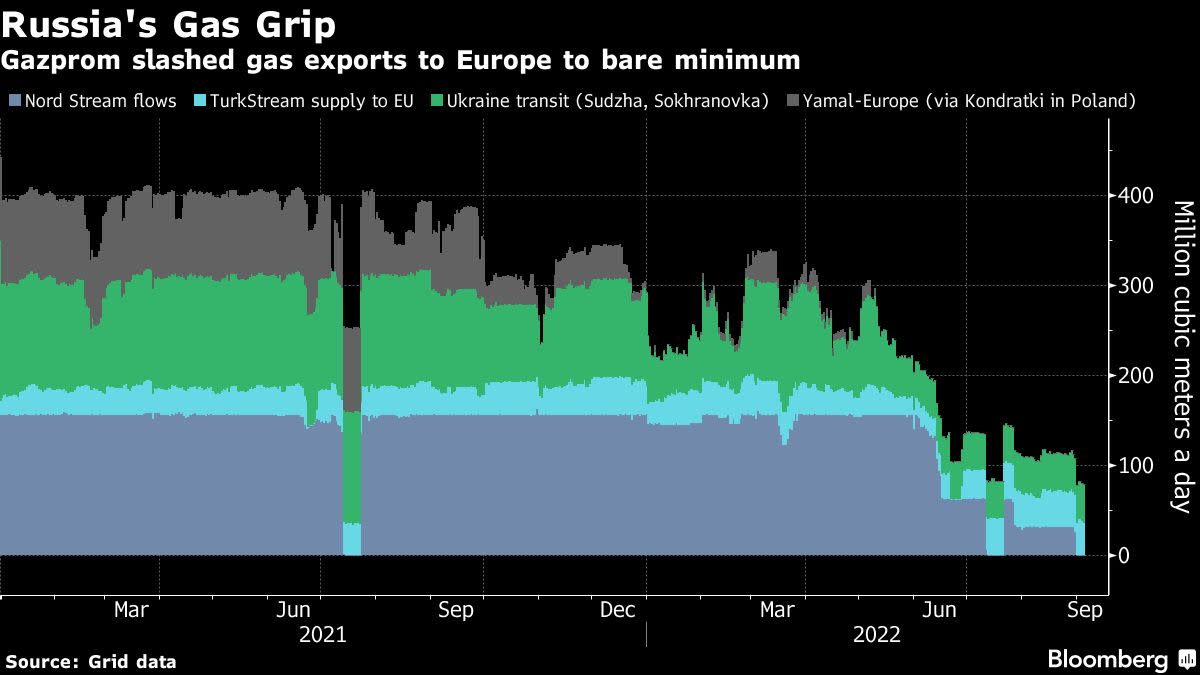

But gas prices are easing — partly on the back of the bloc’s willingness to act. The key question for markets is whether her proposal to mandate a 5% reduction in gas consumption survives the various negotiating stages. While politically difficult, it would be a major step to curb the energy deficit that the continent has been facing since Russia started squeezing its gas flows.

Markets are also hoping for moves from European regulators to ease the strain on energy traders caused by ballooning collateral demands. The commission is in talks with financial regulators, and the European Securities and Markets Authority said on Tuesday it’s “actively considering whether, besides such supervisory monitoring, any regulatory measures are necessary.”

Several countries have already taken steps to backstop energy firms, in an effort to stop the crisis turning into a Lehman moment. Any centralized measures on liquidity are still being hashed out.

“We know that there are some strains around liquidity. We need to be able to address those with the regulators and to understand how it will work effectively,” EU financial services commissioner Mairead McGuinness said in an interview over the weekend. “We’re looking at circuit breakers as well, but again, the details are for further evolution.

The main points of Von der Leyen’s plan, according to the latest drafts, are:

-

Capping the power-generation revenues of renewable and nuclear companies at 180 euros ($180) per megawatt hour. Utility shares rose on Tuesday as that level is still higher than pre-war levels.

-

A levy on companies in oil, gas, coal and refinery industries of at least 33% of their extra profits. Based on pre-tax profits of fiscal year 2022 that are more than 20% higher than the average of the three years starting in 2019. It’s exceptional and temporary and up to member states to apply.

-

A target to cut overall consumption by 10% and a mandatory goal lowering demand during selected peak hours by 5%

The challenge will be to find an EU-wide solution that fits each of the member states with their varying sources of energy, wealth and industrial strength. A meeting of energy ministers last week left clear how deep some of the divisions are.

Keen to get a deal in place before October — when the winter heating season starts — the Czech Republic, which holds the EU’s rotating presidency, has called another emergency meeting for Sept. 30. With inflation surging and cost-of-living protests growing, Brussels is trying to hold a degree of unity and prevent a free-for-all of policies that ultimately undermines the single market.

“There is no magic wand to bring prices back to the pre-war levels. But with a targeted emergency package, we can ease the pressure on prices, and help citizens,” said EU Energy Commissioner Kadri Simson.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.