The UK economy shrank in the three months to June amid the worst inflationary crisis in decades.

GDP fell on a quarterly basis for the first time since the start of last year, amid a 0.6pc output fall in June alone.

The 0.1pc contraction follows growth of 0.8pc in the first three months of 2022, according to the Office for National Statistics (ONS).

Britain’s dominant services sector shrank 0.4pc, as the Government’s vaccine drive and test and trace programme continued to wind down.

Production output climbed as more households and businesses turned the air conditioning on to cope with hot weather, increasing energy demand. Construction output also rose across the quarter.

June’s decline marked the worst monthly drop since January 2021, when the country was in a stringent winter lockdown.

The economy is expected to grow during the current quarter, before slumping into a recession later this year as rocketing prices crush activity and demand.

08:29 AM

Trade deficit widens to new record amid scramble for fuel

The UK’s trade deficit widened to a record £27.9bn across the second quarter amid a boom in demand for fuel, according to the ONS.

It says:

Total imports increased by £14.3 billion to £206.6 billion, and total exports increased by £12.3 billion to £178.6 billion.

Part of this was due to inflation, statisticians said: adjusted for price risest, the deficit narrowed by £2.4bn to £22.6bn.

08:12 AM

FTSE 100 rises

It’s been a slightly stronger-than-expected open for the FTSE 100 after those expectation-beating growth figures. The blue-chip index is up about 0.25pc at the moment.

07:58 AM

Niesr: Economy already in recession

The venerable National Institute of Economic and Social Research reckons the UK is already in a recession – standing out somewhat by predicting another fall in output this quarter.

As a reminder, two consecutive quarters of negative growth is the typical definition of a recession.

Stephen Millard, its deputy director for macroeconomic modelling and forecasting, says:

It now looks like the UK economy entered a recession in the second quarter of this year as GDP fell by 0.1 per cent, and we expect output to continue falling over the next three quarters.

07:52 AM

Reaction: Economy holding up ‘better than expected’

Here’s some of the reaction to this morning’s GDP numbers

Ruth Gregory from Capital Economics:

The better-than-expected GDP figures for June suggests that the economy is holding up a little better than we had thought in the face of sky-high inflation. Even so, the GDP figures confirmed that the economy contracted by 0.1pc q/q in Q2 and we have not altered our view that a recession is on the way later this year.

Thomas Pugh from auditor RSM :

The huge rise in energy bills in Q4 is likely to tip the economy into a recession that will last roughly a year and see a peak-to-trough fall in GDP of around 1pc-2pc. The big picture is that the economy could be no larger in 2025 than it was in 2019, before the pandemic.

James Smith from the Resolution Foundation:

While the contraction in June partly reflects the timing of Platinum Jubilee bank holidays, the economy has started a difficult period on a weak footing… The first priority for the new Prime Minister will be to provide further targeted support to low-and-middle income households who will be worst affected by the stagflation that already seems to be taking hold.

07:41 AM

More on that recession…

The Bank of England has predicted that the economy will fall into a recession at the end of 2022, lasting well over a year.

Here’s how its prediction looked – although it already appears to have been too downbeat about the second quarter.

Both Tory leadership candidates have pledged more support for households struggling to pay their bills.

Liz Truss, the frontrunner to take over from Boris Johnson as Prime Minister, has rejected the idea that a recession is inevitable. The foreign secretary has promised immediate tax cuts to boost incomes.

“We can change the outcome and make it more likely the economy grows,” she said last week.

Her rival Rishi Sunak has claimed Ms Truss’s “unfunded” tax cuts would pour “fuel on the fire” of inflation, which is expected to hit 13.3pc in October, when the energy price cap is expected to surge.

07:38 AM

Tourism and hotels benefit from fall in cases

The ONS said tourist attractions and hotels benefitted after Covid-19 travel restrictions were lifted at the end of March.

Days out increased, helping to boost the leisure industry, while the Queen’s Platinum Jubilee celebrations drove a surge in sales at mobile food stands and takeaway food shops, even as the extra bank holiday in June dragged down monthly output.

Most analysts expect the economy to bounce back over the summer (July to September), before a surge in energy bills this October drags the economy back into decline.

07:36 AM

Wind-down of pandemic-era schemes was biggest drag on services

Britain may have been returning to ‘normal’ for much of the second quarter, but cut both ways for growth thanks to the winding up of the Government’s massive pandemic-era health schemes.

Across services, the ONS says “the largest negative contribution from human health and social work activities, reflecting a reduction in coronavirus (COVID-19) activities”.

Overall:

There was a 5.4pc fall in human health and social work activities, reflecting a large reduction in coronavirus activities, such as NHS Test and Trace, COVID-19 vaccination programme and lateral flow orders over the second quarter.

Here’s how that looks in the context of service contributions to growth more widely:

07:32 AM

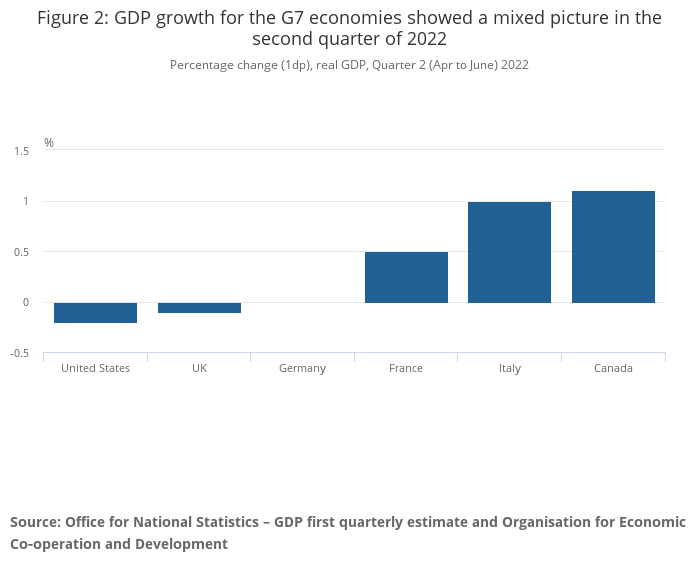

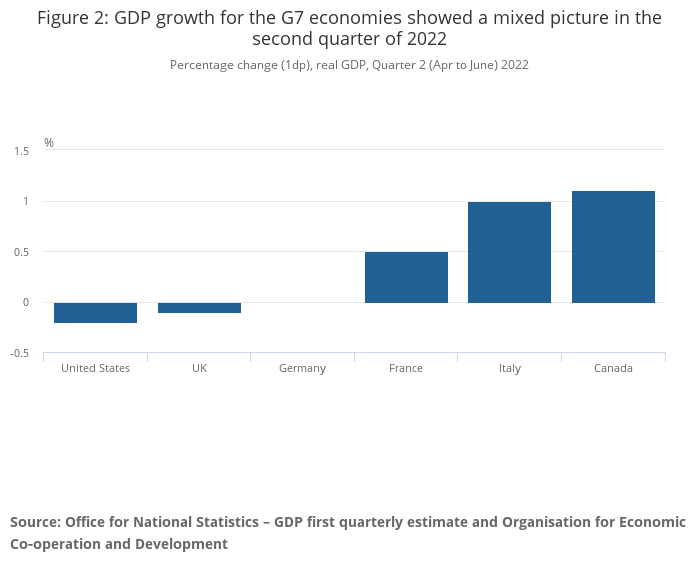

British growth second-worst in G7

Here’s that 0.1pc decline in the context of other G7 countries. As you can see, the UK has found itself near the bottom of the pack, with only the US (which has entered a technical recession) performing worse.

07:28 AM

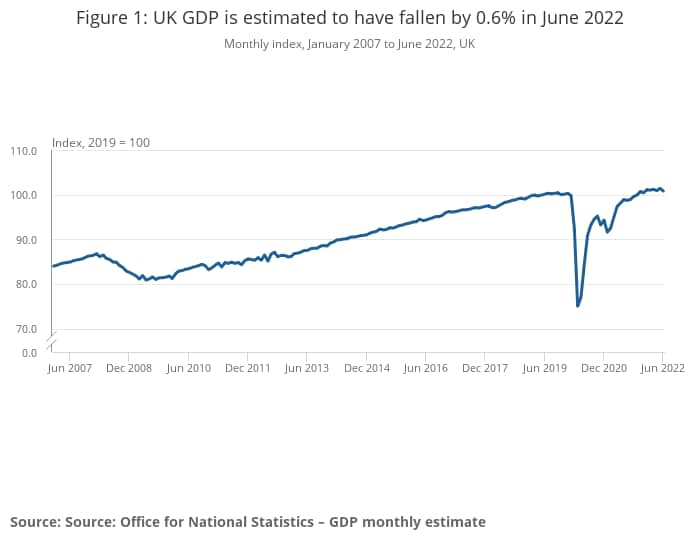

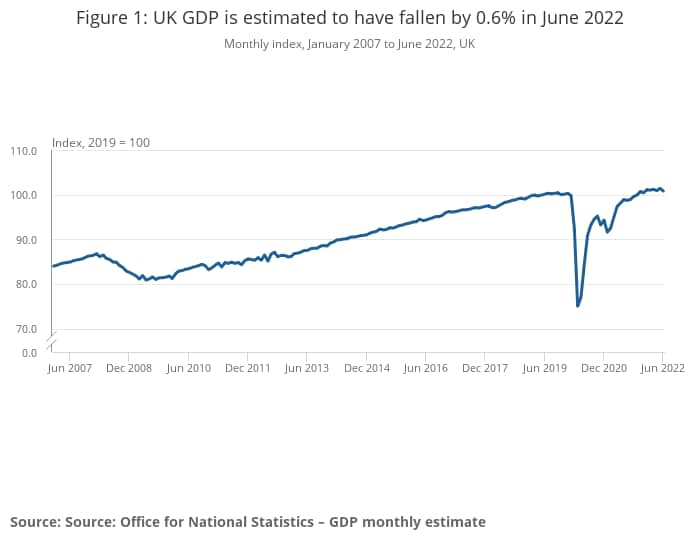

Economy still bigger than before pandemic

Despite the overall quarterly fall, and the 0.6pc June decline, the UK economy is still 0.9pc bigger than before the pandemic (i.e. February 2020) on a monthly basis, per the ONS:

07:23 AM

Hard to price in Jubilee impact

The Queen’s Platinum Jubilee celebration certainly had an impact on growth in June, says the ONS, although on first read it seems statisticians struggled to put an exact number on it.

They say:

The Platinum Jubilee, and the move of the May bank holiday, led to an additional working day in May 2022 and two fewer working days in June 2022. This should be considered when interpreting the seasonally adjusted movements involving May and June 2022.

One area where the festivities appear to have caused a clear boost is eating out: estimates from booking service OpenTable show a 23pc increase in seated restaurant diners during the week containing the Jubilee bank holidays.

In the broad though, it was pretty muted. The ONS says “there was little impact on the quarterly estimates” from the celebration.

07:16 AM

‘Too early’ to call recession

Yael Selfin, chief economist at KPMG UK, says it is “too early” to call a recession. She adds:

Temporary factors such as an extra bank holiday and the phasing out of the Test & Trace scheme were behind the fall in GDP in Q2. While we see increasing signs of underlying weakness in the economy, we expect a more severe downturn to take place only from towards the end of this year.

07:15 AM

Zahawi: We can pull through

Here’s Chancellor Nadhim Zahawi’s response to those figures:

Our economy showed incredible resilience following the pandemic and I am confident we can pull through these global challenges again.

I know that times are tough and people will be concerned about rising prices and slowing growth, and that’s why I’m determined to work with the Bank of England to get inflation under control and grow the economy.

07:14 AM

Snap take: First quarterly contraction since early 2021

Britain’s economy shrank by 0.1pc between April and June amid the worst inflationary crisis in decades.

GDP fell on a quarterly basis for the first time since the start of last year, amid a 0.6pc output fall in June alone.

That marked the worst monthly drop since January 2021, when the country was in a stringent winter lockdown.

The economy is expected to grow during the current quarter, before slumping into a recession later this year as rocketing prices crush activity and demand.

Darren Morgan, the ONS’s director of economic statistics, said:

Health was the biggest reason the economy contracted as both the test and trace and vaccine programs were wound down, while many retailers also had a tough quarter. These were partially offset by growth in hotels, bars, hairdressers and outdoor events.

07:05 AM

Decline across all major sectors

All sectors suffered a decline in output during June, although manufacturing came out of the quarter looking unscathed despite soaring prices.

07:03 AM

Slowdown less sharp than feared

Both today’s headline numbers came in softer than economists had feared:

07:02 AM

Breaking: Economy suffers quarterly contraction

Just in: The UK economy shrank by the slimmest of margins during the second quarter, with GDP falling by 0.1pc after a 0.6pc decline in June.

06:57 AM

Agenda: Britain braced for contraction

Good morning. It’s all about growth this morning, as we get June figures for GDP that will complete numbers for the second quarter.

National output is expected to have taken a 1.2pc knock in June, down in part to the Platinum Jubilee celebrations. Across the quarter, that’s expected to result in a 0.2pc fall.

Elsewhere, the FTSE 100 is on course for a flat day, after falling yesterday despite wider optimism about calming inflation.

5 things to start your day

1) British EDF customers pay twice as much as French for energy Macron’s price cap on state-owned supplier shields households from soaring costs

2) Hong Kong suffers record fall in population as people flee zero-Covid curbs The city lost 113,200 residents in the year to June

3) Breaking up HSBC would unlock up to £29bn payday, says Chinese shareholder Insurer accuses lender of ‘exaggerating’ challenge of spinning off its Asian business

4) Heathrow sale revives hopes of a third runway under new Prime Minister But whoever enters Number 10 still faces environmental hurdles and a sector in flux

5) Mark Zuckerberg branded ‘creepy’ by Facebook’s own chatbot Social media company ‘exploits people for money’, artificial intelligence program warns

What happened overnight

Asian markets mostly fell on Friday, winding back some of the previous day’s rally, as traders come to terms with the likelihood that central banks will continue to raise interest rates to battle runaway inflation.

Asia struggled to maintain momentum, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Manila, Jakarta and Wellington all slightly lower.

Tokyo, however, jumped more than 2pc and investors there returned from a one-day break to play catch-up with Thursday’s bounce. Taipei also rose.

Coming up today

-

Corporate: 888 Holdings, Flutter Entertainment, TBC Bank Group (interims)

-

Economics: GDP (UK), industrial production (UK, EU), manufacturing production (UK), Michigan consumer sentiment index (US)