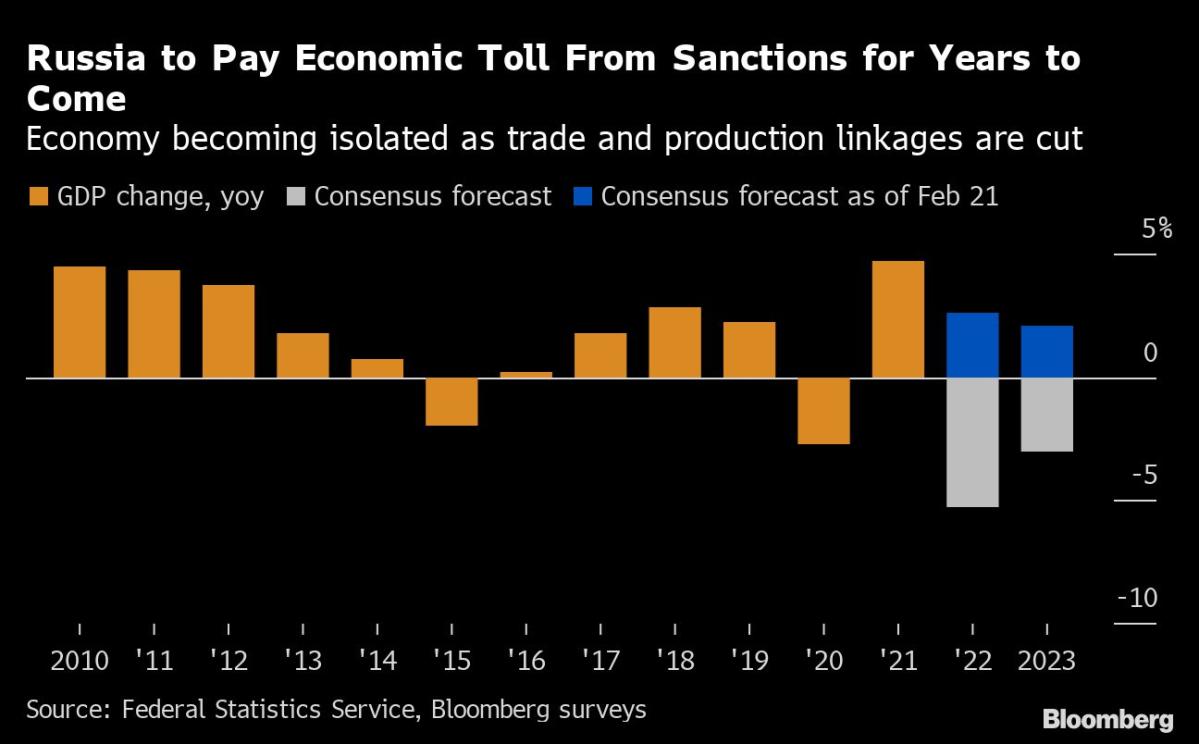

(Bloomberg) — Russia faces a sharp and prolonged slump in its real income as international sanctions over President Vladimir Putin’s invasion of Ukraine leave deep scars on its economy, according to a study by two Chinese academics.

Most Read from Bloomberg

The severing of trade links and access to multinational production may cut real income by almost 12% and result in a “permanent decline in real gross domestic product” for Russia, Xiayi Du and Zi Wang from Shanghai University of Finance and Economics said in the study published in the journal Economics Letters.

“This welfare loss is mainly due to losing access to foreign final goods and intermediates,” they said.

One of the most downbeat assessments to date of the fallout from Putin’s war modeled the effect of isolation on Russia from all economies except China, its biggest trade partner. While China hasn’t joined the penalties, the risk of falling afoul of secondary sanctions may still constrain business ties.

The US and its allies have pushed through repeated rounds of sanctions since the Feb. 24 invasion, imposing restrictions that now extend from energy to finance and prompting hundreds of foreign companies to leave. Though Russia’s economy has adjusted and will likely suffer a shallower recession than first feared, damage over the long term remains more uncertain and harder to quantify.

The Chinese economists found that Russia will sustain a smaller but still substantial welfare loss of nearly 10% if sanctions only affect trade and leave production linkages intact. Their model included 44 economies and 34 sectors.

“Multinational production is important in understanding the impacts of economic sanctions,” they said. “We should pay more attention to the recent news indicating that many western multinationals have withdrawn from Russia since the start of the Russia-Ukraine war.”

The economic blowback will extend beyond Russia, albeit slightly, according to the study. Trade and production cutoffs will decrease the real income of eastern European countries by 0.56% and bring it 0.25% lower in Western Europe.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.