President Xi Jinping on Wednesday conveyed his support for China’s mobile payments and financial technology platforms at a senior leadership meeting, where he encouraged these operators to “play a bigger role” in strengthening the world’s second-largest economy.

That meeting by the Central Comprehensively Deepening Reforms Commission, a policy formulation and implementation body headed by Xi, approved a work plan on “enhancing regulation over big payment platforms, while promoting regulated and healthy development of payment and fintech businesses”, according to an official statement published by state-run Xinhua News Agency.

Xi said China’s payments and fintech platforms should “return to their roots”, which is a veiled reference to refrain from disorderly expansion and anticompetitive behaviour that had brought major risks to China’s finance sector.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Although no specific companies were mentioned in the meeting, the commission’s positive signal may augur well for Ant Group, the world’s largest fintech company and operator of payment services giant Alipay. Hangzhou-based Ant has been under a state-guided restructuring process since its initial public offering (IPO) in Shanghai and Hong Kong was abruptly called off by regulators in November 2020.

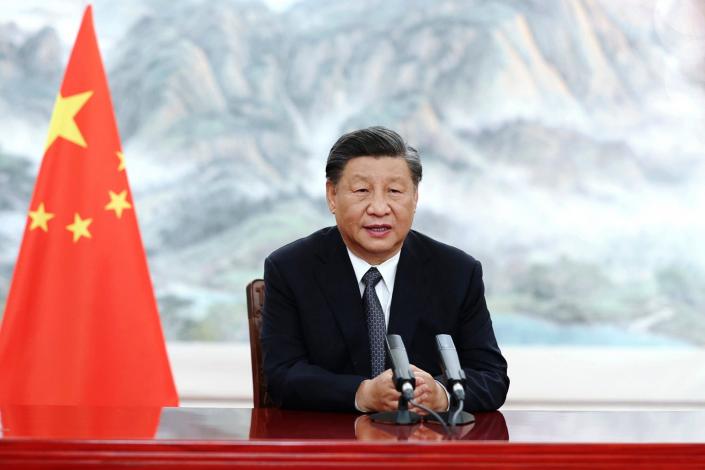

Chinese President Xi Jinping delivers a keynote speech in virtual format for the opening ceremony of the BRICS Business Forum on June 22, 2022. Photo: AP alt=Chinese President Xi Jinping delivers a keynote speech in virtual format for the opening ceremony of the BRICS Business Forum on June 22, 2022. Photo: AP>

China’s digital payments and fintech platforms are expected to help “ensure security” of their industry’s infrastructure and “prevent systemic financial risks”, according to the commission’s statement. These platforms are also encouraged to “play a bigger role” in bolstering the economy and support China’s economic goal of dual circulation, which is laid out in the 14th five-year plan for 2021-25 and the country’s Vision 2035 strategy.

The latest initiative by the commission, which was formed in 2013 under the Politburo of the ruling Chinese Communist Party, reflects Beijing’s pledge this year to support the “healthy development” of the online services sector, as the country’s economy reels from the outsize impact of regulatory crackdowns and zero-Covid-19 controls.

The easing up of regulatory scrutiny, however, has fanned speculation that Ant, an affiliate of Alibaba Group Holding, may be poised to revive its IPO. Alibaba owns the South China Morning Post.

Ant earlier this month denied that it was working on a new plan to go public. The China Securities Regulatory Commission also said it was not conducting any assessment regarding the potential resumption of the firm’s IPO.

There has also been speculation on whether Ant will apply for a financial holding licence from the country’s central bank, the People’s Bank of China. Ant declined to comment on Thursday.

Alibaba’s shares in Hong Kong, meanwhile, closed up 6.4 per cent to HK$108 on Thursday.

China’s economy showed initial signs of recovery in May, ahead of an anticipated rebound in the second half of this year aided by a raft of government stimulus measures.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2022 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2022. South China Morning Post Publishers Ltd. All rights reserved.