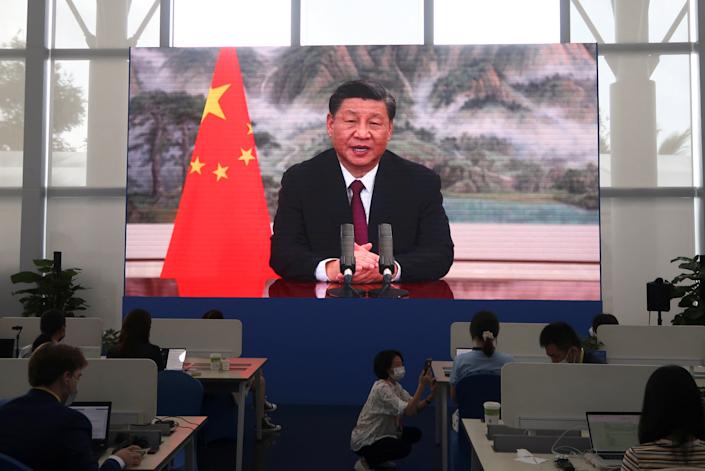

Chinese President Xi Jinping recently called for an “all-out” effort this week to boost the world’s second-largest economy through infrastructure investments, signaling growing internal concerns about China’s growth prospects.

That may not be enough to reach its stated 5.5% GDP target if lockdowns stemming from the country’s zero-COVID policy remain in place beyond April, according to one analyst.

“If the economy — if 40% of the population is locked down or 40% of GDP in the country is locked down — you could talk all you want about stimulus, but what are you going to stimulate?” Leland Miller, the CEO of China Beige Book, told Yahoo Finance (video above). “You won’t have the typical options to just juice the economy in a normal way. So, you know, they’re in a very tough spot. Q2 has the potential to be an absolute bloodbath.”

China’s economy grew at a rate of 4.8% in the first quarter, beating expectations, b the country has struggled to contain its worst outbreak of the coronavirus since the beginning of the pandemic.

The lockdowns have brought Shanghai, its largest city and financial capital, to a crawl. Factory shutdowns and a slowdown at the world’s largest port have only increased pressure on the Chinese government to reassess its stringent zero-COVID policy.

And over the weekend, a spike in COVID cases in Beijing prompted officials to implement limited lockdowns that led to panic buying across the capital.

“If you’re shutting down these major metropolises, if you’re shutting down four of the largest ports in China for multiple weeks, if not maybe months, then yeah, you’re going to have a supply chain disaster on your hands,” Miller said.

‘A fairly rocky period ahead’ for China

The draconian measures have rattled investor confidence.

A sell-off on the mainland stock exchanges Monday led to a 6% decline in the Shenzhen Component while the Shanghai Composite (000001.SS) fell more than 5%. Meanwhile, the Chinese yuan (CNY=X) fell to its weakest level since November 2020 and the unemployment rate rose to 6% in 31 cities across the country in March, the highest on record.

Faced with growing headwinds, Xi Jinping turned to a familiar playbook Wednesday, calling for growth through massive infrastructure investments, echoing the debt-fueled policy the government unleashed in the wake of the financial crisis.

Miller said any stimulus may prove to be moot, if the government fails to control COVID infections and stick to its zero-COVID policy.

“It’s not about whether these cities are shut down for one or two weeks,” Miller said. “The question is whether they’re shut down for April into May, maybe all of May. If you’ve got zero growth or contractionary growth during that period, then you’ve got a bigger problem on your hands.”

The latest COVID wave in China comes as countries struggle to clear supply chain backlogs stemming from pandemic-related closures in China last year.

At the Port of Los Angeles, Executive Director Gene Seroka told Yahoo Finance that 50 container ships remain offshore, waiting to be processed. While this marks a dramatic turnaround from the record backlog of vessels last year, it still remains above pre-pandemic levels.

Seroka said the Port is monitoring trucking power, transportation, energy consumption, and even pollution in China’s largest ports to anticipate additional slowdowns.

According to Michael Hirson, head of China and Northeast Asia at the Eurasia Group Practice, a further pullback in activity may be inevitable given the lack of progress in controlling the infections.

“It’s difficult,” Hirson said. “As long as you’re maintaining zero COVID, there’s going to be difficulties in terms of logistics because drivers need to get through, workers need to show up to factories. Fundamentally, I think we’re still in for a fairly rocky period ahead just given the fundamental challenge of what they’re trying to do.”

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter @AkikoFujita

Read the latest financial and business news from Yahoo Finance