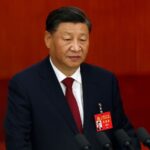

China said Monday it will delay the release of economic growth figures, as the country’s leadership gathers for a meeting set to hand President Xi Jinping a historic third term in office.

The announcement comes a day before China had been expected by analysts to announce some of its weakest quarterly growth figures since 2020, as the economy is hobbled by Covid-19 restrictions and a real estate crisis.

Beijing’s National Bureau of Statistics (NBS) announced that the release of growth figures for the third quarter along with a host of other economic data would be “postponed”, without specifying a reason for the delay or giving a new timeline.

The postponement comes as officials from China’s ruling Communist Party gather in Beijing for their 20th Congress, which is set to rubber stamp Xi’s bid to rule for another term.

Zhao Chenxin, senior official at the National Development and Reform Commission, told reporters on Monday morning that “the economy rebounded significantly in the third quarter.”

“From a global perspective, China’s economic performance is still outstanding,” he said.

But many analysts had expected the world’s second-largest economy to struggle to reach its growth target this year of around 5.5 percent, with the International Monetary Fund lowering its GDP growth forecast to 3.2 percent for 2022.

A panel of experts polled by AFP last week predicted average growth of three percent in 2022 — a long way off the 8.1 percent seen in 2021.

That would have marked China’s weakest growth rate in four decades, excluding 2020 when the global economy was hammered by the emergence of the coronavirus.

Separately, customs authorities delayed the release of September’s trade figures last week, without providing an explanation, while the NBS said on Monday it would also postpone the release of monthly data on indicators including real estate and retail sales.

– Covid impact –

China’s economy has been hit particularly hard by the government’s strict zero-Covid policy.

The country is the last of the world’s major economies to continue to follow the strategy, which imposes tight travel restrictions, mass PCR testing and obligatory quarantines.

It also involves sudden and strict lockdowns — including of businesses and factories — that have disrupted production and weighed heavily on household consumption.

China is also battling an unprecedented crisis in its real estate sector — historically a driver of growth in the economy and representative of more than a quarter of the country’s GDP when combined with construction.

Following years of explosive growth fuelled by easy access to loans, Beijing launched a crackdown on excessive debt in 2020.

Property sales are now falling across the country, leaving many developers struggling and some owners refusing to pay their mortgages for unfinished homes.

tjx/oho/mca