(Bloomberg) — Australian Treasurer Jim Chalmers is aiming to establish the new Labor government’s fiscal credibility in his budget update, mindful of the chaos generated by the UK’s shock announcements and a domestic backdrop of hot inflation and rising interest rates.

Most Read from Bloomberg

Economists predict Tuesday’s fiscal blueprint will show an underlying cash deficit of A$35 billion ($22 billion), or 1.4% of GDP, in the 12 months through June 2023. That’s down from 3.4% of GDP forecast by the previous government when it laid out its budget plan in late March.

Australia Will Bank Windfall as China Wobbles, Treasurer Says

The difference mainly reflects windfall revenue from soaring commodity prices following Russia’s invasion of Ukraine.

Chalmers has sought to downplay expectations, saying his budget will be “solid” and “sensible,” delivering on Labor’s May election pledges and trying to pare back spending where possible. The government is acutely aware of the need to avoid adding to demand and making the Reserve Bank’s job even harder.

The treasurer told Bloomberg in an interview Sunday that he had taken some lessons from the UK’s disastrous mini-budget, which set off wild market fluctuations and ended in the the resignation of Prime Minister Liz Truss last week.

“You’ve got to nicely line up your fiscal policy and the monetary policy and when that gets out of whack the markets and others will react,” Chalmers said.

Australia Under Pressure to Revise Tax Cuts Following UK Chaos

Incoming Australian treasurers traditionally try to paint a bleak picture of the economy and budget they’re inheriting in order to tarnish their opponents and lay a baseline to show improvement under their stewardship.

Chalmers and Prime Minister Anthony Albanese have been highlighting risks around the economic outlook, including the prospect of more than A$1 trillion in government debt.

What Bloomberg Economics Says

“Tighter monetary policy and elevated inflation are a significant challenge for policymakers. The UK experience highlights that governments are walking a fiscal policy tightrope. The cost of policy errors is high. But in Australia’s case, surging revenues from elevated commodity prices and a fully-employed economy are providing a massive fiscal safety net.”

–James McIntyre, economist

But that argument is complicated by a fully employed economy. In addition, while the budget is deep in deficit due to the pandemic, a A$50 billion revenue windfall from high export prices will temporarily improve the bottom line.

Still, the debt and deficit left by the previous center-right government do provide Chalmers with an opening to rewrite a traditional narrative in Australian politics — that the country’s conservatives are better economic managers than Labor.

Chalmers, who served as a senior adviser to former Treasurer Wayne Swan during the 2008-09 financial crisis, is well placed to bolster Labor’s credentials, says Chris Wallace, a professor at the University of Canberra.

“Chalmers has a tough task,” she said. “But he’s a sensible, well prepared, intelligent treasurer backed by a department that’s still delivering very good policy advice. I expect we’ll see a very strong first outing from him.”

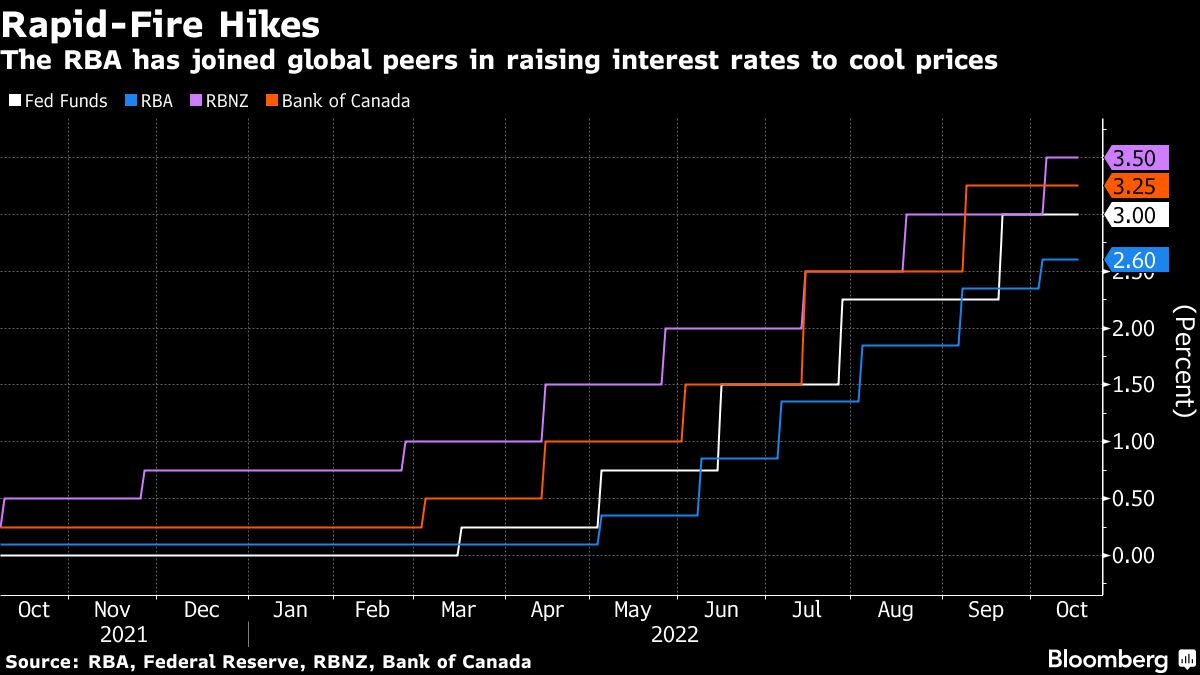

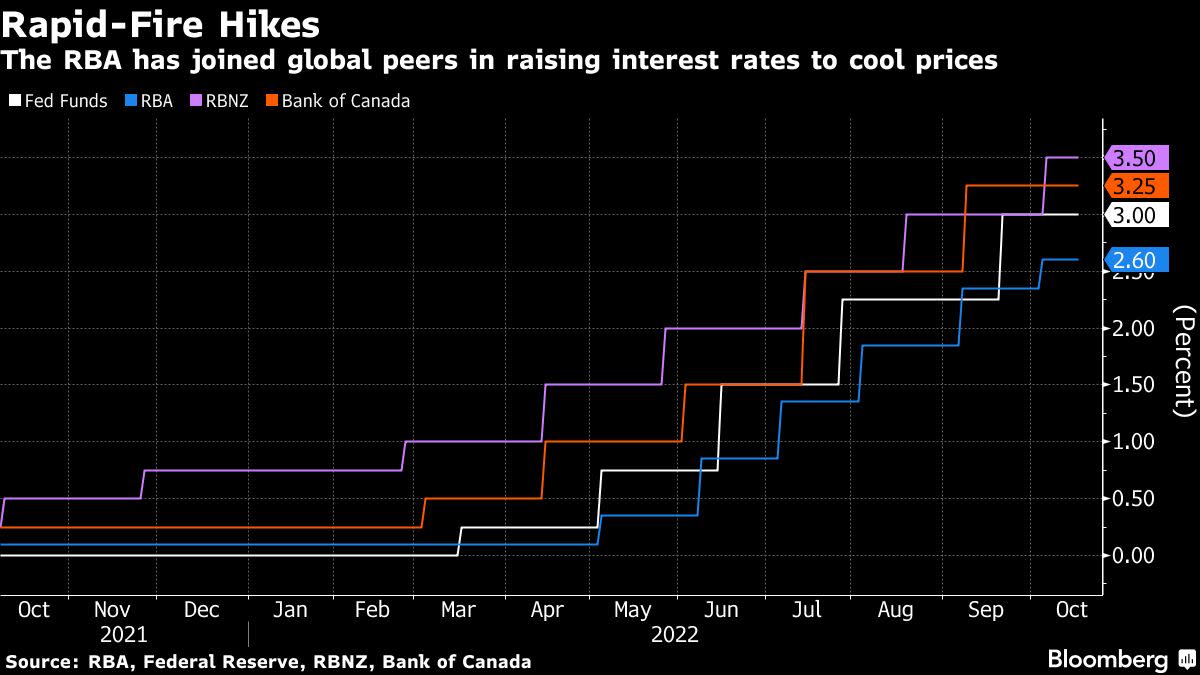

A Labor treasurer would normally want to quickly boost spending to aid low-income households, and the budget will provide some relief, but Chalmers is wary of adding to price pressures that have already pushed the RBA into its sharpest tightening cycle in a generation.

Treasury sees a quarter-percentage point hit to GDP growth and about an 8% increase in fruit and vegetable costs from floods that have inundated farmland across Australia’s east coast.

Inflation probably accelerated to 7% in the third quarter, the fastest pace in 32 years, economists predicted ahead of data out Wednesday. Finance Minister Katy Gallagher said indexation of government payments to inflation is set to lift budget spending by A$30 billion over four years.

Chalmers will also lay out economic forecasts in Tuesday’s budget that are likely to see downgrades to GDP growth and employment as rising borrowing costs cool demand. The RBA has raised rates by 2.5 percentage points in six months and further hikes are expected.

Stephen Halmarick, chief economist at Commonwealth Bank of Australia, reckons a budget deficit of 1%‑1.5% of GDP will be an important signal to financial markets.

“Small budget deficits will also help net debt decline as a share of GDP, adding comfort to Australia’s AAA credit rating,” he said.

Some lawmakers have suggested an easy savings measure would be to reconsider legislated tax cuts favoring high-income earners starting mid-2024, particularly after the chaos in the UK.

But, having gone to the election pledging to keep the tax cuts, Albanese and Chalmers are so far sticking with the measures at an estimated cost of A$250 billion over 10 years.

The treasurer told Bloomberg that he sees the current global inflation shock as potentially the third major international downturn of the past 15 years, following Covid and the 2007-08 crisis. But he says this one needs a different response to the prior two.

“When you’ve got all this uncertainty around the world you need a responsible budget at home and that’s what Tuesday night will be.”

–With assistance from Tomoko Sato and Ainsley Thomson.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.