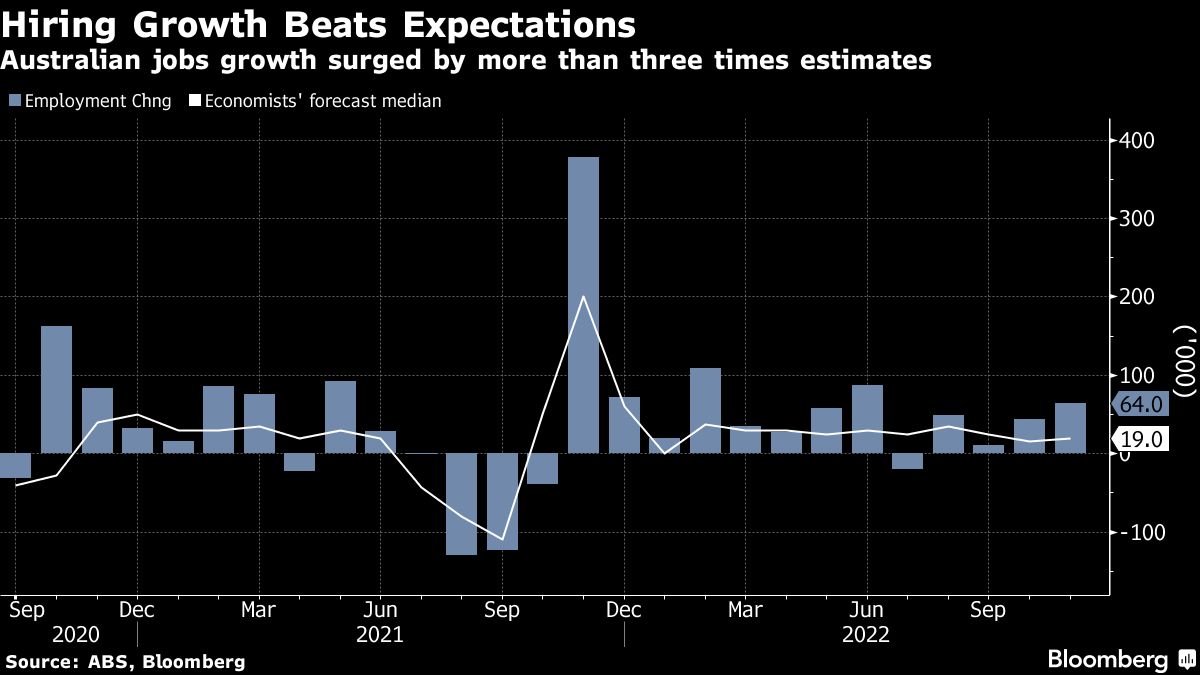

(Bloomberg) — Australian employment surged by more than three times economists’ estimates in November and unemployment held at a 48-year low, bolstering the case for the Reserve Bank to raise interest rates further in 2023.

Most Read from Bloomberg

Government bond yields rose after the economy added 64,000 roles, trumping a forecast 19,000 gain, official data showed Thursday. The participation rate climbed to 66.8%, matching a record, while unemployment stayed at 3.4%.

The report highlights the resilience of developed-world labor markets to rapid rate rises, increasing the likelihood central banks will have to drive borrowing costs even higher to prevent elevated inflation becoming entrenched.

The Reserve Bank of Australia has hiked by 3 percentage points since May, its sharpest annual tightening cycle since 1989, and economists reckon it will push the cash rate to a peak of 3.6% in 2023, from the current 3.1%.

“The Australian economy retains strong momentum, which in turn argues against any pause by the RBA at the February policy meeting,” said David Bassanese at Betashares Holdings Pty. “The major story of 2022 has been the economy’s resilience to date in the face of interest rate hikes.”

The Australian central bank’s board doesn’t meet in January.

Labor market strength is a key reason the RBA reckons it can avoid a recession in the A$2.2 trillion ($1.5 trillion) economy even as it tightens sharply. The RBA expects unemployment will remain around 3.4%-3.5% through mid-2023 and wage growth is seen edging up, but staying below 4% through end-2024.

“If wage growth can remain benign, Australia faces a vary good chance of getting away with only a soft landing in 2023, even if the US economy tumbles into recession,” Bassanese said.

Chair Jerome Powell said overnight the Federal Reserve has more work to do after raising its key rate by 50 basis points to a 4.25% to 4.5% target range, and projecting it would end next year at 5.1%. Earlier this month, data showed US employers added more jobs than forecast and wages surged.

In Australia, key to expectations of persistent labor market strength are elevated job vacancies.

“Australia continues to have a record-breaking labor market with almost every major metric doing things we either haven’t seen before or haven’t seen in a long time,” said Callam Pickering, economist at global job site Indeed.

“It’s hard to envision the labor market deteriorating significantly in the near-term when there are still so many jobs available.”

That said, economists do expect conditions to soften in 2023 amid signs the RBA’s tightening is impacting some parts of the economy.

House prices are on a downward spiral while data this week showed consumer sentiment remained deeply pessimistic and business confidence turned negative for the first time this year.

What Bloomberg Economics Says…

“The tide is turning in the labor market. As the unemployment rate rises through 2023 we see the central bank reversing course and cutting rates late in the year”

— James McIntyre, Economist.

To read the full report, click here

Today’s report also showed:

-

Underemployment fell 0.2 percentage point to 5.8% and underutilization declined 0.1 point to 9.3%

-

Full-time roles rose by 34,200, while part-time gained by 29,800

-

Monthly hours worked declined, while the employment to population ratio rose to 64.5%

–With assistance from Tomoko Sato.

(Updates with comments from economists.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.