(Bloomberg) — South Africa’s rand faces a fresh challenge amid uncertainty about the fate of Finance Minister Enoch Godongwana, who’s battling allegations of sexual assault and may be forced to step down.

Most Read from Bloomberg

Should Godongwana be sidelined just two months ahead of a budget update, the rand would likely extend a decline sparked by concerns about Federal Reserve tightening that have boosted the dollar, said George Glynos, the managing director and chief economist at ETM Analytics.

“It would be received poorly” if the “well-respected” finance minister was pushed out, Glynos said. “The stakes are so high on this.”

While Godongwana has denied the allegations, he has said he’s prepared to step down if charges are brought against him. The South African police sent a docket on its investigation into the allegations to the National Prosecuting Authority, which will decide whether the minister should be prosecuted.

Still, traders may be underpricing the risk, if volatility measures are anything to go by. Three-month implied volatility for the dollar versus the rand, reflecting the market’s anticipation of future price swings, was little changed on Friday and down since the beginning of the month.

“How much of the political premium is priced in, with all that is going on worldwide, is difficult to say,” said Cristian Maggio, the London-based head of portfolio strategy at TD Securities. “External factors do weigh more than the purely domestic drivers in this context, but amid global uncertainties, you can expect the market to look more closely at the political idiosyncrasies — or perhaps just treat them as an additional risk factor that requires further asset price premia.”

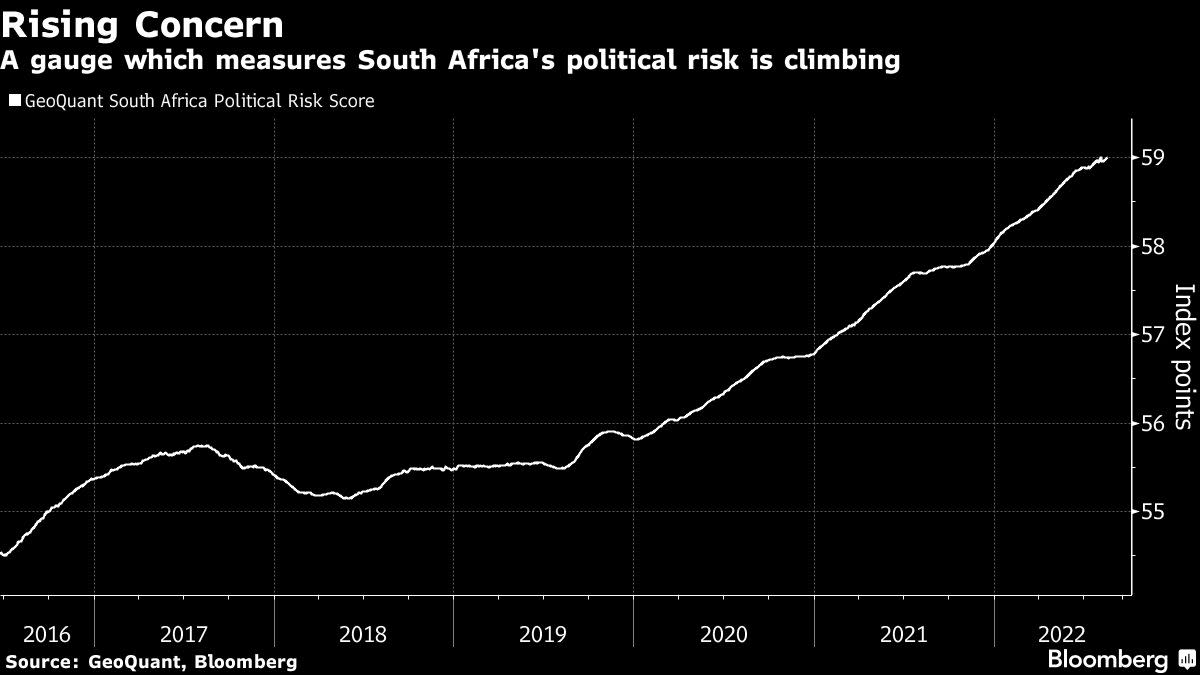

South Africa’s political risk score as measured by GeoQuant indexes is rising amid the saga. President Cyril Ramaphosa is also embroiled in a scandal that has weakened him politically, following allegations he concealed the theft of foreign currency from his private game farm. Ramaphosa has denied any wrongdoing.

Both Ramaphosa and Godongwana may have to step aside ahead of a leadership contest in the ruling African National Congress at the end of the year. The ANC is considering changes to its constitution to automatically expel members charged with serious crimes to increase accountability within its ranks.

“This is all just an extra reason not to get too bullish the ZAR,” said Christopher Shiells, a managing analyst at Informa Global Markets. “I think if any of these political risks actually develop then they will cause some further rand losses.”

The currency declined 0.9% to 17.006 per dollar by 2:11 p.m. in Johannesburg. It’s headed for a 5% drop this week, its biggest since the five days ended April 22 and the fourth-worst performance among 23 developing nations monitored by Bloomberg.

Investors are already speculating about a possible replacement for Godongwana. He could be replaced by “a technocrat from National Treasury,” but such a person wouldn’t have the political clout to effect policy reforms, said Glynos. Godongwana “has gotten a lot done, because he is well respected within the ANC’s ranks and commands respect, both intellectually and politically,” he said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.