Wall Street’s relentless decline stretched into a sixth week on Monday, fueled by new data from China that added to concerns about a global economy that’s being battered by high inflation, rising interest rates and a malfunctioning supply chain.

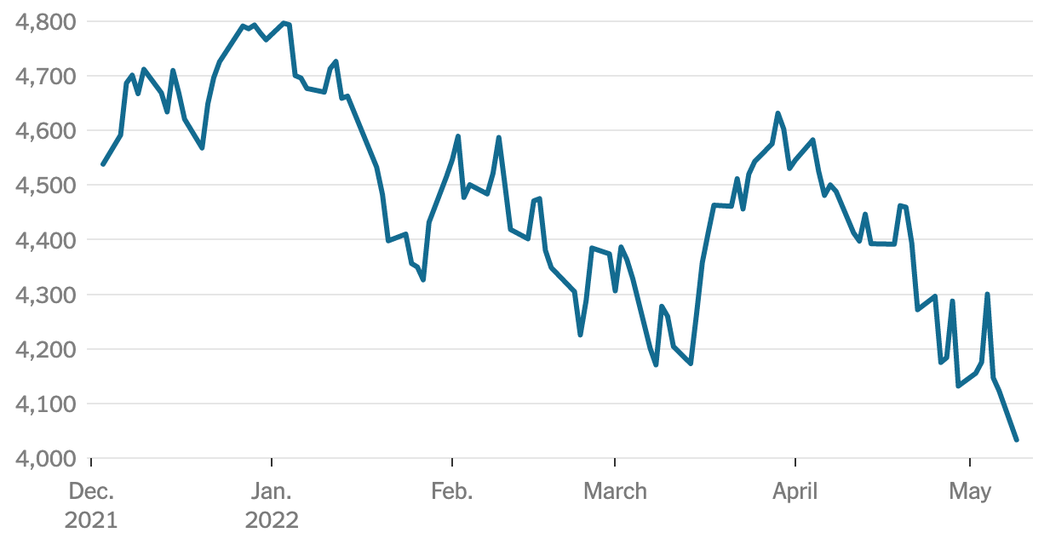

The S&P 500 fell 3.2 percent, adding to a downdraft that has knocked 16.3 percent off the index this year, including a five-week stretch of selling that is the market’s longest such decline in more than a decade.

The drop has stocks approaching a bear market, Wall Street’s term for a decline of 20 percent or more from recent highs, a retreat that serves as a marker of a severe shift in sentiment.

The focus of attention on Monday was China’s economy, after customs data showed that growth in the country’s exports slowed significantly in April and Li Keqiang, the Chinese premier, warned this weekend that the current state of the nation’s jobs market was “complicated and grave.”

The trade slowdown was a product of China’s efforts to contain a Covid-19 outbreak with lockdowns that have idled millions of workers, as well as weaker demand for Chinese-made products from the United States and Europe, economists said, and the news ricocheted through global markets: Oil prices slid more than 6 percent, dragging shares of oil producers lower, while stocks in Europe and Asia also plunged. The Euro Stoxx 600 fell 2.9 percent, and the Hang Seng Index in Hong Kong dropped 3.8 percent.

Investors have a long list of reasons to back away from stocks right now. Rising prices and higher interest rates are sure to hurt consumption in the United States, while the war in Ukraine and the lockdowns in China are hampering supplies of everything from food to energy, exacerbating the inflation problem.

The Federal Reserve’s effort to cool the economy also means that a crutch for investors over the past two years, cheap borrowing costs and easy access to capital that helped fuel a staggering rally in stocks, is starting to fade.

There’s no sign that any of Wall Street’s major concerns will be resolved soon. The Fed, which raised its benchmark interest rate half a percentage point last week, is expected to keep raising rates until it is confident that consumer prices are finally under control — something investors fear will result in an economic slump in the United States.

On Monday, Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, said during an interview that, if the economy doesn’t respond to the Fed’s interest rate increases, it might have to ramp up its efforts to cool growth. That could include raising interest rates by three quarters of a percentage point in one go, though he doesn’t think that is necessary right now.

“If the economy doesn’t respond, to me, a 75-basis-point move could be appropriate — but we won’t know that for some time,” he said, later adding, “If we really started to see inflation moving strongly away from our 2 percent target, further away, that would be a real concern.”

Conversely, any sign that inflation is easing, allowing the Fed to consider slowing its campaign to raise interest rates, would help allay concerns, analysts said.

Annual inflation reached 8.5 percent in March, its fastest pace in over 40 years, with fuel and food driving prices higher, and economists expect that price gains will have slowed slightly when the data on the Consumer Price Index for April is released later in the week. One month of better data probably won’t be enough to calm markets, analysts say, but it could be a start.

“The bottom line is that markets don’t like uncertainty and the current macro environment is tenuous at best,” said Brian Price, head of investment management at Commonwealth Financial Network. “Any positive developments on the geopolitical front, or softer-than-expected inflationary readings, could help to abate the recent selling pressure.”

No matter when it ends, there’s no question that the recent stretch of volatility has stood out in a market that for years was remarkably placid.

In 2021, there was seemingly no bad news that could stop the U.S. stock market, with the S&P 500 gaining 26.9 percent, and the index had daily gain or loss of more than 2.5 percent just once, on Jan. 27, as meme stocks like GameStop and AMC Entertainment spiked in a speculative frenzy and the Federal Reserve said a resurgent coronavirus was weighing on the economic recovery.

That started to change when the Fed moved away from describing inflation as “transitory,” or something that might end as pandemic lockdowns eased, and instead adopted a more aggressive tone toward cooling down rapid prices. Through Monday, there have already been eight days this year with gains or losses of at least 2.5 percent — about one in every nine trading days. All those big daily changes have been in March, April and May.

Strings of big gains and losses are more typical of recessions and the periods that follow them. Before the pandemic wreaked havoc on the stock market in 2020, the last string of big changes was in 2007-11, during the financial crisis and the recovery from it. Before that, the dot-com boom and bust, and the Sept. 11, 2001, attacks, brought volatility.

Bear markets are similarly uncommon, with the last two having occurred in early 2020 and in the financial crisis before. The 20 percent trigger for a bear market — like the 10 percent trigger for what investors call a “correction” — are somewhat arbitrary thresholds, but they serve as mile markers to show that investors have turned pointedly more pessimistic about the world.

The reasons for that pessimism abound right now, and will “drag the S&P 500 into a bear market,” said Victoria Greene, chief investment officer at G Squared Private Wealth, an advisory firm.

“We still have some structural problems — a hawkish Fed, Ukraine, commodity price pressure, Covid shutdowns in China, inflation — that are pressuring growth expectations,” she said. “The pressures from the macro world are too much for stocks to overcome at this point.”

Reporting was contributed by Claire Fu Jeanna Smialek Melina Delkic and William P. Davis.