(Bloomberg) — European Union leaders overcame weeks of division to clinch a deal on partially banning Russian oil, but calls to target one of Putin’s other big moneymakers, gas, are opening new rifts in the bloc.

Most Read from Bloomberg

In the hardest-hitting measure targeting Russia’s lucrative energy sector, the government chiefs agreed to pursue a ban on the purchase of seaborne oil and petroleum products from Russia, with a temporary exemption for pipeline crude. While the details must still be hashed out, the deal prepares the ground for a sixth package of sanctions to punish President Vladimir Putin for invading Ukraine.

“Yesterday proved that the EU is able to maintain unity in the face of Russian aggression,” Czech Prime Minister Petr Fiala told reporters Tuesday, the second day of a leaders’ summit in Brussels. “The talks were pragmatic and went faster than expected, which is a strong message for Putin.”

With ambassadors set to discuss the package Wednesday, Latvian Prime Minister Krisjanis Karins said the bloc must push ahead on gas. But he noted the bigger challenge because supplies of the fuel — on which EU members like Germany are heavily dependent — are harder to replace. “You can put oil in lorries and move it around easily,” he told Bloomberg TV. “To move gas you need specialized equipment.”

In the weeks that the EU wrangled over oil, Poland and the bloc’s Baltic members argued that until gas is included, sanctions won’t go far enough. But the members are split on discussing this in a next, seventh package, with some leaders seeing quick action unlikely.

“This package is a big step forward, we should pause it right now,” Belgian Prime Minister Alexander De Croo told reporters, calling a gas embargo “way more complicated.”

While Irish Prime Minister Micheal Martin called Tuesday’s late-night agreement a “watershed moment” for the EU’s dependence on Russian energy, he made clear consensus on gas would be harder. Slovenia’s Janez Jansa wished his colleagues “good luck” on finding a solution, while Estonia’s Kaja Kallas, who has been one of the bloc’s strongest advocates for stricter measures against Putin, was also cautious.

“I think that gas has to be in the seventh package,” Kallas said. “But I’m realistic as well I don’t think it will be there.”

The sixth package envisions covering more than two-thirds of oil imports from Russia, “cutting a huge source of financing for its war machine,” European Council President Charles Michel said in a tweet.

Once officials and diplomats agree on the technical details, the sanctions must be formally adopted by all 27 nations. The European Commission has proposed to ban seaborne crude oil six months from adoption, while refined petroleum products would be halted in eight months.

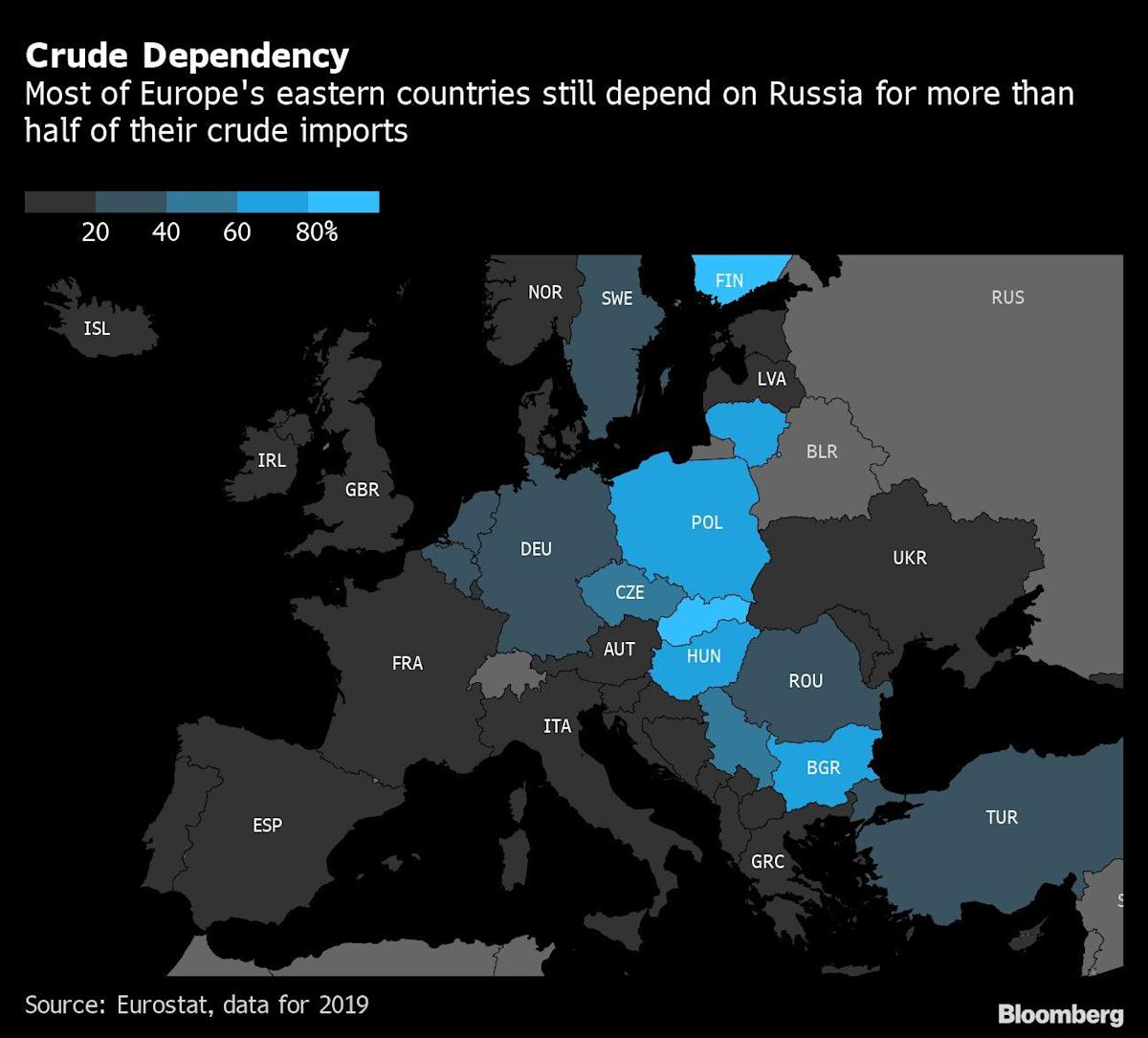

Shipments of oil through the giant Druzhba pipeline to central Europe will be spared until a technical solution is found that satisfies the energy needs of landlocked nations including Hungary, which will continue to receive Russian oil via pipeline.

Hungarian Prime Minister Viktor Orban had blocked an embargo as he sought assurances its energy supplies wouldn’t be disrupted but Budapest received guarantees from EU leaders that it would be able to receive replacement supplies if the pipelines are disrupted, according to two people familiar with the talks.

Oil headed for the longest run of monthly gains in more than a decade following the news. Brent crude topped $123 a barrel, a two-month high.

The bulk of the current pipeline deliveries are to Germany and Poland, which have signaled they will wean themselves off Russian supplies regardless of any EU action. Berlin committed in writing to stick to that pledge on Monday, one of the people said. If both countries follow through, the total effect, along with seaborne embargo, would be to cut 90% of Russian crude oil sales to the EU by year’s end.

Seaborne supplies account for about two-thirds of Russian oil imports, and once in place, the measure would cost Putin up to $10 billion a year in lost export revenue, according to Bloomberg calculations. That’s because the ban would force Russia to sell its crude at a discount to Asia, where it’s already changing hands at about $34 a barrel cheaper than the price of Brent futures.

But it’s a small share of the $270 billion Russia’s government is forecasting for energy exports this year. Russia shipped about 720,000 barrels a day of crude to European refineries through its main pipeline to the region last year. That compares with seaborne volumes of 1.57 million barrels a day from its Baltic, Black Sea and Arctic ports.

Other measures in the proposed EU sanctions package include:

-

Cutting three more Russian banks off the SWIFT international payments system, including Russia’s largest lender Sberbank.

-

Banning the ability to provide consulting services to Russian companies and trade in a number of chemicals.

-

Sanctioning Alina Kabaeva, a former Olympic gymnast who is “closely associated” with Putin, according to an EU document; and Patriarch Kirill, who heads the Russian Orthodox Church and has been a vocal supporter of the Russian president and the war in Ukraine. Hungary, however, opposed sanctioning Kirill, the people said.

-

Sanctioning dozens of military personnel, including those deemed responsible for reported war crimes in Bucha, as well as companies providing equipment, supplies and services to the Russian armed forces.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.